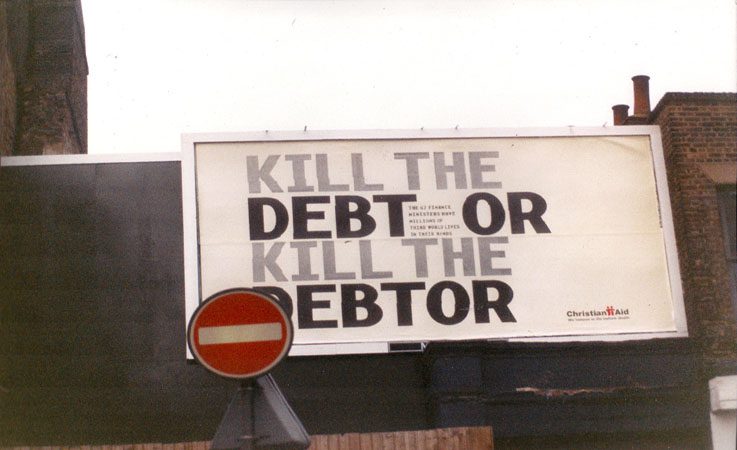

Picture Credit: Infoletta Hambach || I suppose Euros are manna from somewhere, though not Heaven. After all, they appear out of nowhere [ECB], and there is no guarantee that any government will receive them in the long run.

“The lure of free money brings out the worst economic behavior in people.”

David Merkel, often said at Aleph Blog

Where is there “free” or at least “inexpensive” money?

- Jobs that are overly compensated compared to the skills needed.

- Demanding that the government give free money to people.

- Constraining interest rates to be low.

- Various “one decision” investment ideas.

- The prices of houses only go up.

- The government bails out bad investments.

- Various investments involving derivatives where one is implicitly short volatility

I started writing this two weeks ago, and then the idea for “Welcome to our Country Club!” came into my head, partially stimulated by a young friend of mine becoming a lifeguard at a swanky country club. It made me think back on my time as a youth being a caddy at a similar club. (And being one of the smallest guys there, I had to learn to defend myself, but that is another story.)

A number of parties have directly and indirectly mused about what I what analogizing in “Welcome to our Country Club!” Real Clear Markets put up a Bitcoin logo. I commented there:

Well, you made explicit what I left implicit. Good job, but you can also throw in penny stocks, meme stocks, some SPACs, etc. Thanks for mentioning me.

Me

In the bullet point above, I listed seven classes of cases where there is free money, or at least subsidized money. I’ll take them in order.

Jobs that are overly compensated compared to the skills needed

There’s always some of that naturally, but it tends to adjust over time unless the government does something to achieve a social goal. That can be unions with a closed shop as an example, or restricting the ability to enter into a simple business, if licensing is too tight. There are corrective mechanisms for both, but they take a long time. Technology can reduce the need for labor in certain types of simple jobs. Or, it can create a competitor to those in a regulated industry (think of Uber, Lyft, Airbnb). In some cases businesses move to non-union venues whether a different part of the US, or another country.

Demanding that the government give free money to people

I’m not in favor of Universal Basic Income. I’m fine with non-subsidized unemployment insurance (though I never tapped it the three times I was out of work — desperation is a good thing).

Many quotes are attributed to Ben Franklin than he actually said. Here’s an alleged one that is interesting:

However, when McHenry made the story public in the 15 July 1803 Republican, or Anti-Democrat newspaper, it had evolved. Now the exchange was:

Powel: Well, Doctor, what have we got?

Franklin: A republic, Madam, if you can keep it.

Powel: And why not keep it?

Franklin: Because the people, on tasting the dish, are always disposed to eat more of it than does them good.

How Dr. McHenry Operated on His Anecdote

If the quote is accurate, it fleshes out the ideas that Republics have to be limited in scope to survive, and that once people that they can use the republic for their self-interests. Even in the recent mini-crisis, knew of a lot of organizations that got PPP loans that didn’t really need them — they profited from the free money. They were organized, with clever accountants, and milked Uncle Sugar while he was throwing money around. (Here’s a particularly notable case.) But there are other places where this happens as well — corporations have gotten very good at slipping ta preferences into the tax code. Even if the US Government wants to encourage a certain behavior, if they are generous, they get overused. This applies to many mass programs as well such as Crop Insurance and Flood Insurance, both of which are subsidized.

The list goes on and on, whether for the upper classes, who benefit the most from this, and the lower classes, who get enough to blunt desperation.

Constraining interest rates to be low

With the Fed following a theory close to Modern Monetary Theory Banana Republic Monetary Theory, it has inflamed three areas of the bond market — Treasuries, Conforming Mortgage Backed Securities, and Junk Corporates. This has pushed housing prices higher, and facilitated high government budget deficits (and the unrealistic spending goals of many), and aided malinvestment by firms that have access to cheap capital, when they should have gone broke.

As Cramer would say, it’s time for me to ‘fess up. I was wrong on my piece Hertz Donut. Cheap capital and the end of the C19 crisis gave equity holders a big win. I know I will sound like the Grandpa from Peter and the Wolf, “What if Peter had not caught the wolf? What then?” To those who didn’t listen to me and won, congratulations. To those who listened to me and lost, I’m sorry. I gave orthodox advice that worked 99% of the time over the prior 60 years. I will give the same advice next time, because you can’t rely on the capital markets to do a favor for you.

When the history books are written 30 years from now, the historians will point at the easy monetary policy of the Fed from Greenspan to date as the major reason US markets overshot and crashed in real terms, along with underfunded promises made by the US and State governments.

Various “one decision” investment ideas

This was the main point of “Welcome to our Country Club!” This can apply to the FANGMAN stocks, promoted stocks whether penny or meme stocks, private equity, cryptocurrencies, etc. There are no permanently good ideas in the markets. Every sustainable competitive advantage is eventually temporary. You don’t own a right to superior returns, at most you can temporarily rent it. Even the idea of buying and holding an S&P 500 index fund means that you will have to endure 50-70% drawdowns once or twice every twenty years or so.

Few truly have “diamond hands.” Perhaps Buffett could have them, but even he makes changes to his portfolio. Let me give a practical example: few people wanted to default on their mortgages during the 2007-2012 crisis, but many were forced to sell at an inopportune time because of unemployment, death, disease, disability, divorce, etc. And far more panicked. There are very few people (and institutions) that are willing to buy the whole way down, and concentrate their holdings into their best ones during a crisis. It hurts too much emotionally to do so, and looks stupid in the short run.

Don’t deceive yourself. Keeping some measure of slack capital (“dry powder”) helps keep you sane. You will look stupid at times like now, but over the long haul you will persevere.

The prices of houses only go up

At least we know from recent memory that residential housing prices can decline across the nation as a whole. On the bright side, current financing terms are not as liberal as they were in 2004-2008. Loan quality is reasonable. But the recent run-up in prices is considerable, in real terms higher than the financial crisis. If we have a significant recession, will there be another crisis?

The government bails out bad investments

One of the failures of the financial crisis was to protect industries that were larger than what was needed. Too many banks, too many houses, too many auto companies, etc. The government, including the Fed, could have protected depositors, but let those who speculated on the continual rise in housing prices fail. They bailed them out with two negative impacts: 1) unproductive investments continue, rather than bein liquidated, which slows growth, and 2) moral hazard — firms take more risk because they know there is a decent chance they will be bailed out in a crisis.

I feel the same way about the recent mini-crisis. We should not have bailed out anyone. The Fed should not have provided excess liquidity. If you don’t let recessions clean out those who have been taking too many chances, you end up with a lot of underperforming junk-rated companies that are non-dead zombies. Over the last 30 years, this is why GDP growth has slowed, we don’t let recessions eliminate subpar uses of capital.

Various investments involving derivatives where one is implicitly short volatility

This was the portion of Where Money Goes to Die that was right in the short-run. During bull markets, many short volatility strategies will make seemingly risk-free steady profits. There are other strategies like it that do well in bull and placid markets, but get killed in a bear market, even a mini-version like early 2018.

Avoid complexity in investing, and stick to simple investments like stocks, bonds, and cash. Stick to things where custody of the assets is almost certain. Cryptocurrencies and derivative strategies typically have weaknesses in custodial matters, such that there are sometimes losses from misappropriation.

Summary

Good investing and good work result from taking moderate risks on a consistent basis. Avoid situations where other are running after what is seemingly free or subsidized money — those situations often come to a bitter end.

And against the advocates for Modern Monetary Theory Banana Republic Monetary Theory, I will tell you that eventually all of the borrowing and spending will come to an end. As in the Great Depression, the rich will ask to have their claims honored at par, while the rest of the nation suffers. Whether the government goes with the rich or not is an open question. But one should not assume that inflation will be the way out… after all, that route could have been taken in greater degree in the Great Depression, but it wasn’t.