“Welcome to our Country Club!”

Image Credit: born1945 || When I was a boy, I spent many days caddying at the local country club.

(This is one of my occasional experiments. Bear with me if you will…)

==========================

Wagner: I don’t get the thrill.

Hawker: What’s not to like?

W: This is nothing like the investment memorandum said it would be.

H: It’s a work in progress. Don’t look at what it is now, think of what it will be like when everyone clamors to join us.

W: This is just a field.

H: So?

W: When I bought a small share in the ownership of this club, the memorandum had pictures of the golf course, lodge, tennis courts, bar, swimming pool, pro shop, and more. All that is here is this field.

H: You needed to read the memorandum more closely. One day we will have all that and more. As for now, we promote the potential of this place to the masses who will want to join us at a much higher price than we got in at.

W: So when will it be built?

H: That is a matter of secondary importance.

W: Huh? What’s of primary importance?

H: Encouraging others to buy shares in this, and never selling our interests.

W: Wait. You did not buy this so you could golf?

H: No merely to own, and never to sell.

W: So this is a speculation on this land?

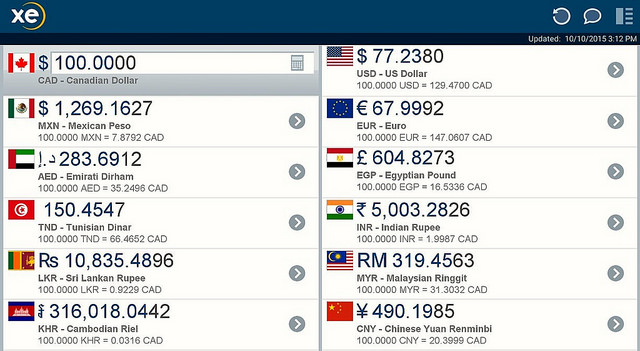

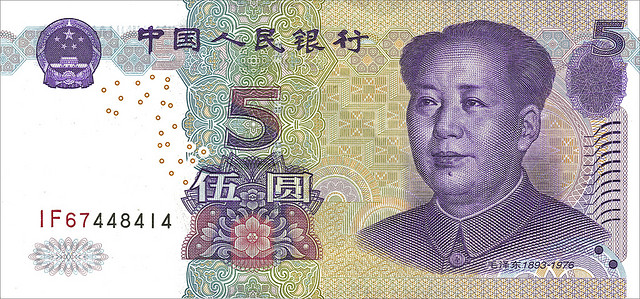

H: Don’t say speculation! Bad word! This is an investment in the concept of getting something valuable in the future. Besides, the country club doesn’t technically own this field yet… there is a memorandum of understanding to acquire it once the price of ownership interests get high enough… at that point we will swap newly issued shares for the land. We transact everything in shares; it is our currency.

W: It doesn’t own this field? What does it own?

H: The future. Everyone is going to want to buy a share in this wondrous venture, and at progressively higher prices. Congratulate yourself, you got in on the ground floor.

W: There is no floor here! Where has the money gone that I have paid?

H: An earlier investor sold you some of his interests. Don’t worry, he still owns over 25% of the shares. Purely a portfolio management decision for him. The Founder strongly believes in the vision for this concept.

W: The concept of building a country club?

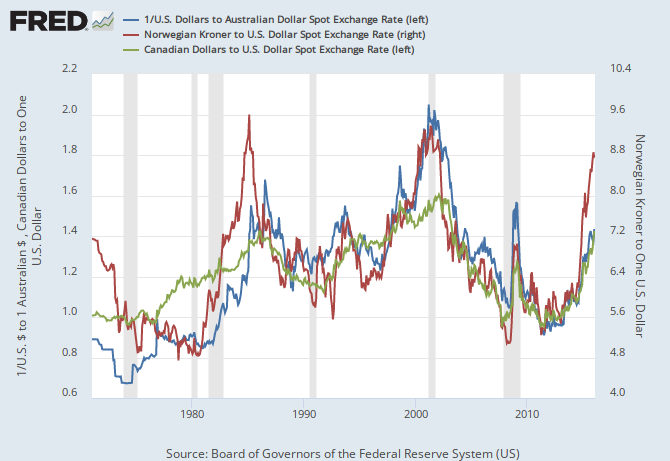

H: The concept of selling interests in the club at ever higher prices to the masses who will want an appreciating asset. And we have the track record. Prices of ownership interests have continually gone up. On a mark-to-market basis, the returns exceed 20%/year. How is that for a successful investment?!

W: I can understand the concept of buying rare and beautiful art to hang on the wall of my house as an investment. It might appreciate over time or not. I enjoy looking at it, and my friends as well, while I pay insurance premiums to protect it for my heirs. Is the only value of this investment possible monetary gain? At least will there be dividends paid?

H: You are missing the point. With this, your heirs will have something far more valuable than a stream of dividends. They will own a share in something that everyone wants to buy. Everyone wants to own an investment that only goes up.

W: So the only driver of value here is others envying what we have, and wanting to buy it from us at prices higher than what we paid?

H: Envy is an ugly word, but yes, and that is why we continually promote how wonderful this investment will be.

W: I am disappointed. I really wanted to golf. Hmm… what if I sold my interests and used the money to go golfing, whether I buy another country club membership, or just hit the links at the local public course?

H: And I am astounded. Why would you give up the glorious future of this enterprise?

W: I want to golf. Say, if you are so convinced, would you buy my interests from me at 5% more than I paid for them?

H: Well, I would be a “better buyer” at that price, but I don’t have enough cash to do that.

W: Would the Founder be interested?

H: The Founder continues to acquire ownership interests as a result of his labors as management. That is how he gets paid. As far as I have heard, he graciously sells them to those who want a piece of the action.

W: Uh-huh. At this point I would rather golf. I will sell my interests to the best bidder.

H: I thought better of you than that. Giving up on an astounding future just to play a game?

W: No, giving up on a game to enjoy life.

![Picture Credit: Peanuts Reloaded || Perhaps today Brexit; Monday an exit from Italy or Spain; [then] Europe dismantles](http://alephblog.com/http://alephblog.com/wp-content/uploads/2016/06/27818910396_39d46df053_o.jpg)