Decentralized Ponzi

Photo Credits: Jared Enos, Stephan Mosel & Pine Tools || Ponzi would have appreciated the cleverness of wallstreetbets

The operation of the “bull pool” at wallstreetbets resembles a Ponzi scheme. There are five things that make it different:

- It is decentralized.

- Because it is decentralized, there is no single party that controls it and rakes off some of the money for himself, at least not directly.

- The assets can be freely sold in a somewhat liquid, but chaotic market. Most Ponzi schemes have time barriers for redemption.

- They caught a situation where shorting was so rampant, that triggering a squeeze was easy. Situations where the shorts are so crowded are rare.

- Gamestop [GME] and other companies whose stock prices get manipulated above their intrinsic value can take the opportunity to sell more shares, as can less than 10% holders of the holders of the stock, and even the greater than 10% holders once six months have passed since their last purchase.

You have to give wallstreetbets credit for one thing, and only one thing: wiping out the shorts. It was an incredibly crowded short, and they identified an easy squeeze. But now it is harder to short, margin requirements have been tightened for both longs and shorts, given the market volatility, and even more so for options. That not only applies to individuals but to brokerages, because with the volatility, there is a greater probability of settlement failure, and broker failure. Robinhood faced possible failure and raised capital. What shorts remain are better financed than previously. When volatility goes up, so must the capital of intermediaries, including brokerages.

Ponzi schemes typically need ever-increasing flows of money to satisfy the cash need from the money being raked off. But there is no sponsor here, so what plays the role of the rake? I can think of three rakes for the money:

- Most fundamentally driven longs have sold. Notable among them is MUST Asset Management of South Korea.

- Some companies like AMC Entertainment and American Airlines are issuing new shares to take advantage of the artificially high price. Maybe GME will do it next week.

- And, those who are more intelligent at wallstreetbets know that GME is overvalued, and have booked their gains. This is definitely a place where the old Wall Street maxim applies: “Can’t go broke taking a profit.” or “Bulls can make money, Bears can make money, but Hogs get slaughtered.” (The Hogs in this situation are the ones who buy and hold GME. Buy-and-hold only works for undervalued assets.)

Now, the grand change that has happened in the last two months is that the investor base of GME has shifted from being fundamental investors to momentum investors. There may be more institutional money pushing GME than is commonly understood. That said, institutional momentum longs tend to react quickly and sell when momentum fails, which makes matters even more volatile. They have more of a risk control discipline than naïve retail investors do.

This is similar to what happens with promoted penny stocks. Fundamentals seem not to matter, just the amount of money thrown at the stock. There is the pump; there is the dump. The amounts of money are bigger here. We have only seen the pump. The dump is coming. And penny stocks almost always lose.

There is no magic in markets — stock prices eventually revert to intrinsic value — it is only a question of how and when. Buyers can force a stock price above intrinsic value for a little while, but eventually the price will sag back, and the only winners will be those who sold stock to them.

When I was younger, I made a mistake with a microcap stock, and placed a market order to initiate a position. (Accident: I typically only use limit orders.) The stock was so thinly traded that I got filled at levels an average of 50% above where the bid was. The price promptly fell back to where it was prior to my purchase. This is what will likely happen with GME, and other situations like it. Mere trading can’t permanently raise the price of an asset.

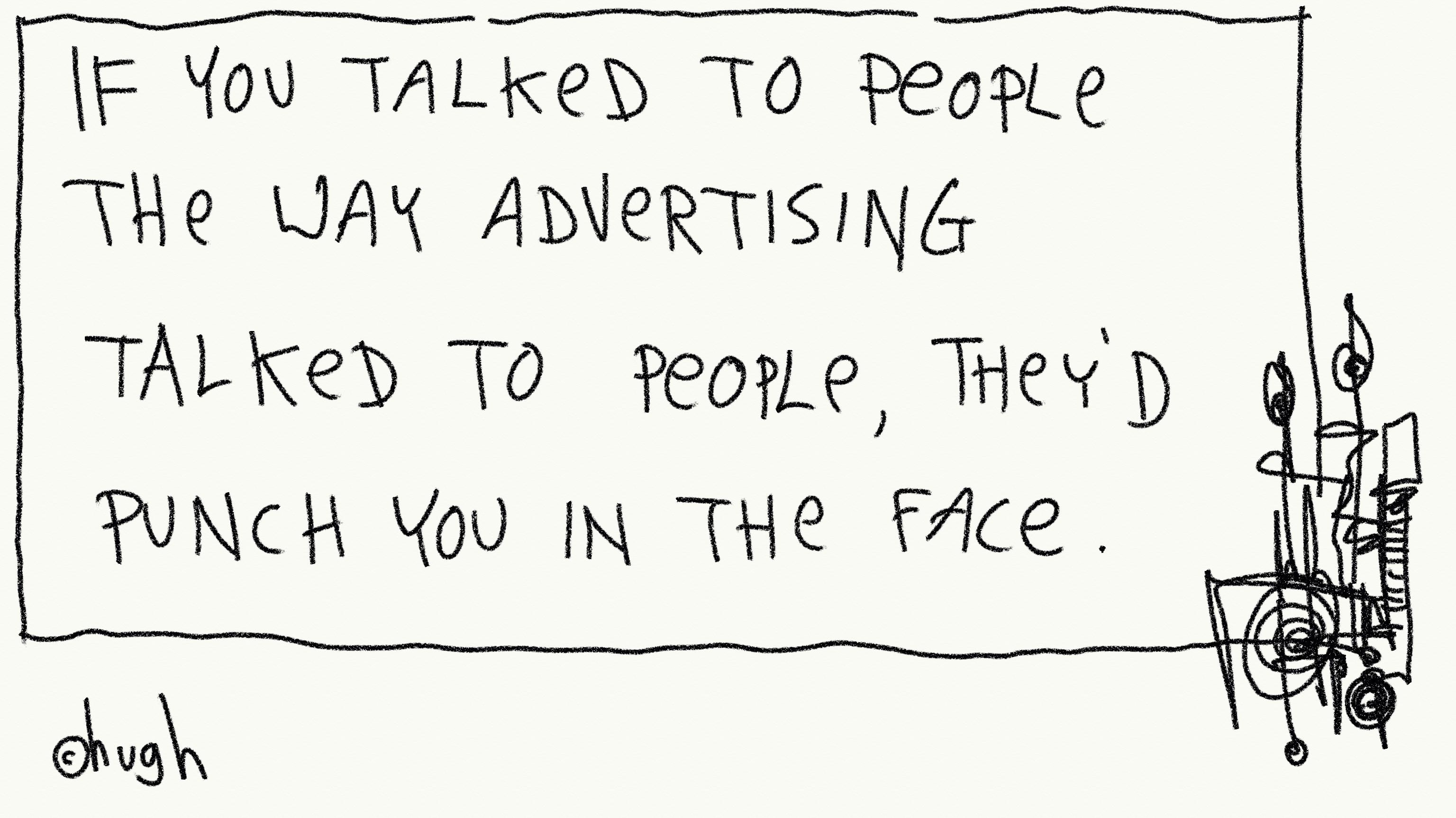

One last note: those at wallstreetbets and places life it should be careful. If you are communicating with other investors about a stock and you make money as a result of the communication, you may face legal troubles if that is deemed market manipulation. And, given that you have communicated it over the internet, that could be deemed “wire fraud.” This is the nature of a government with vague laws that likes to say “gotcha” when they deem something unsavory as illegal.

Do I think it should be illegal? No. Is it unethical? Certainly. No one should promote anything like a Ponzi scheme. But in US culture now, unethical and illegal get confused, and the ideas of “mail fraud,” “wire fraud,” etc., can be applied to unethical actions that may not strictly be illegal. Such logic has been applied to promoted penny stocks, with significant wins against the promoters.

So, to those at wallstreetbets, I would say that you are living on borrowed time. This isn’t going to work, and you and those that follow you will lose money, whether the government comes after you or not. Just as the Hunts tried to corner the silver market, and failed miserably as people sold their silver sets, and miners mined like crazy, in the same way pushing stock prices too high will only lead to dilution from the corporations, and losses to the buyers who came in late., if not the early ones as well.

Look out below.