The Future is More Variable than the Present

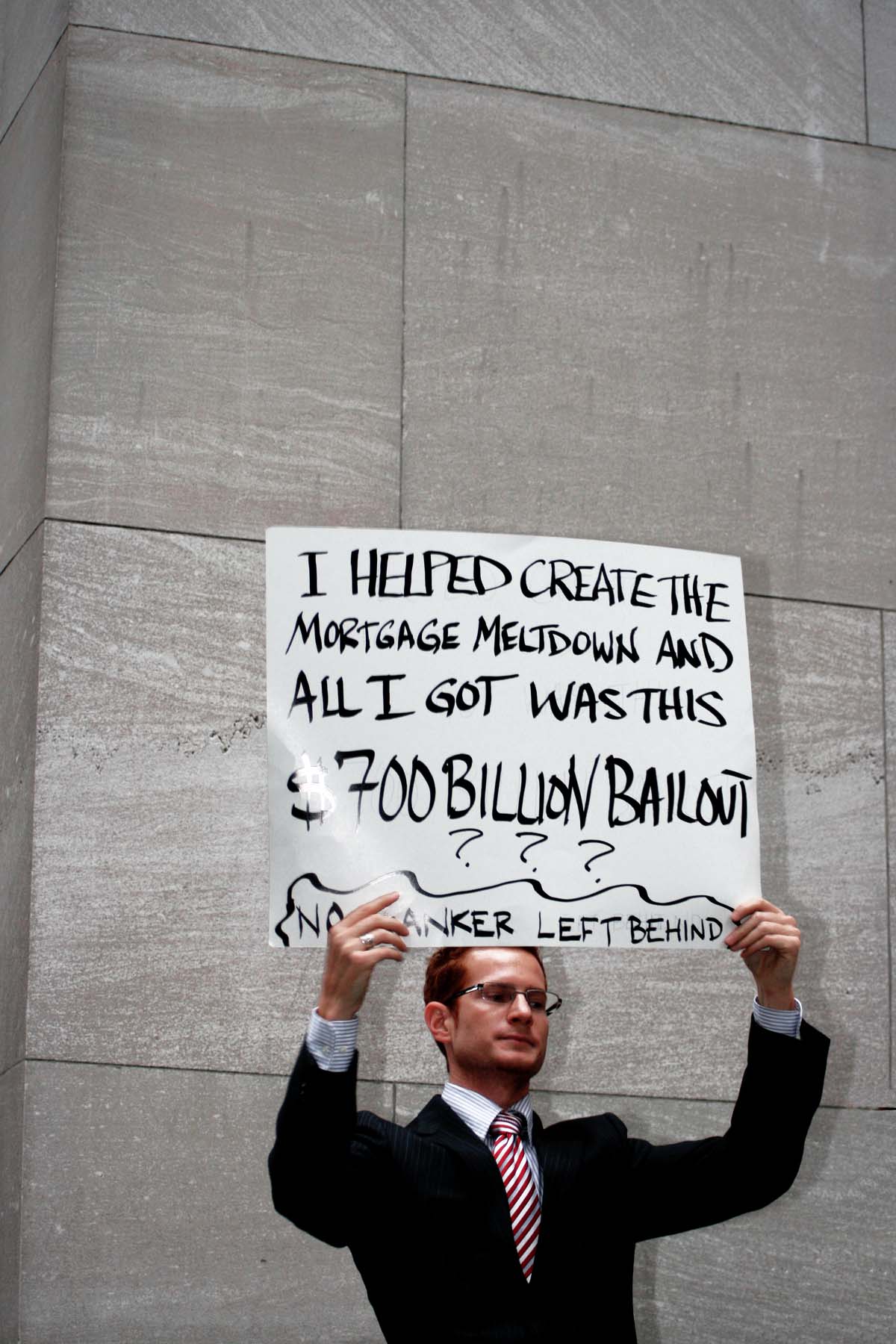

Photo Credit: Michael Dales || Futuristic, and with a twist

Well, I am back. This post will test whether images will post or not. My guess right now is not, so maybe I have more work to do.

Once I know that images will post, I will repost the deleted articles. On to tonight’s piece:

===================================

There are many who get annoyed at the concept that the market is rallying while unemployment is soaring. Though this is not true now, others get annoyed at the market falling when the economy is humming along quite nicely.

My friend Howard Simons said something like, ďStocks arenít GDP futures.Ē† There are several reasons for this:

- When corporate bond yields fall, stock valuations tend to rise. When corporate bond yields rise, stock valuations tend to fall. Corporate bond yields fall when there is economic weakness, and rise when there is economic strength.

- Stocks react to changes in estimates of future profits (or free cash flow). That doesn’t have much to do with present economic distress or success.

- When there is a disaster, not all stocks share in the trouble equally. Companies with strong business models. low operating leverage and strong balance sheets get hurt less. The other companies fall into distress. The financial stress on those companies can lead to sales of assets, letting go of employees, and perhaps default. Those getting unemployed often work for a different group of companies than the ones where their stock prices are rising. (Creative destruction benefits society in aggregate, but not everyone benefits. Those who benefit do not all benefit equally.)

The main thing is there is only one present, and there are many possible futures. Shifts in government policy, particularly during times of stress, can rapidly shift estimates of what the future may hold, which makes the market move.

As such, I encourage caution when markets are moving rapidly. We know the future poorly, but in general optimism triumphs so long as there is overall stability. As I said 13+ years ago:

“Moderate bullishness should be the posture of most investors because absent famine, plague, war on your home soil, and aggressive socialism, markets tend to appreciate over the intermediate term.”

Closing Comments for 3-1-07

Now all that said, don’t assume that recent bullishness is fully correct. Valuations are high. Part of that is that corporate bond yields are low. But if anything happens that shifts expectations of profit margins down for a long time, there is room for the market to fall. Treasury yields might fall in a scenario like that, but corporate yield spreads would rise more.

It’s a good time to pick through your portfolio and find what might not survive so well if the economy does not pull together as quickly as we might like. Avoid marginal names that could be subject to distress. For non-financials and non-utilities, one test is to look at the ratio of debt to market capitalization, and consider scaling back positions where the the ratio is over one.

Remember, you are your own best defender. Moderate risk taking generally wins, so trim back the aspects of your investing that don’t fit that.

PS — If you want a “blast from the past” you can read the piece When the Sirens Sing, How to Avoid Giving inÖ I quote some of my old lost columnist conversation posts from 2006, including one entitled “More Things Can Go Wrong Than Will Go Wrong.” Maybe that could have been today’s title.