Review Your Credit Profile

Picture Credit: Daniil Vin || As a condtion of using the picture, his firm is CreditDebit Pro. This is NOT an endorsement of his services; it is a “thank you” for use of the image.

Before I start this evening, I want to mention three old articles that I have written on personal credit issues. Now some of my articles on having enough cash on hand would also apply, but the following three articles meet the topic the best:

- On Credit Scores

- The Asymptote of Joy and Woe (Okay, this is a cash management article, but it could have been written through the lens of credit scores as well.

- Long-term Relationships and Credit Scores

The last article is a little “out there” but the range of things that credit scoring can affect is huge. For a humorous over the top take on such a system that has gone out of control, consider the Webtoon LUFF, which just recently completed.

As I said earlier regarding the many ways credit scores get used:

The same is true for many other uses of credit data. Different parties want different aspects of the underlying data. Whether it is employers, lessors, lenders, insurers, etc., in an impersonal world, where there are fewer shared ethical values than in the past, economic actors rely on semi-public data to get comfortable about who they are dealing with.

On Credit Scores

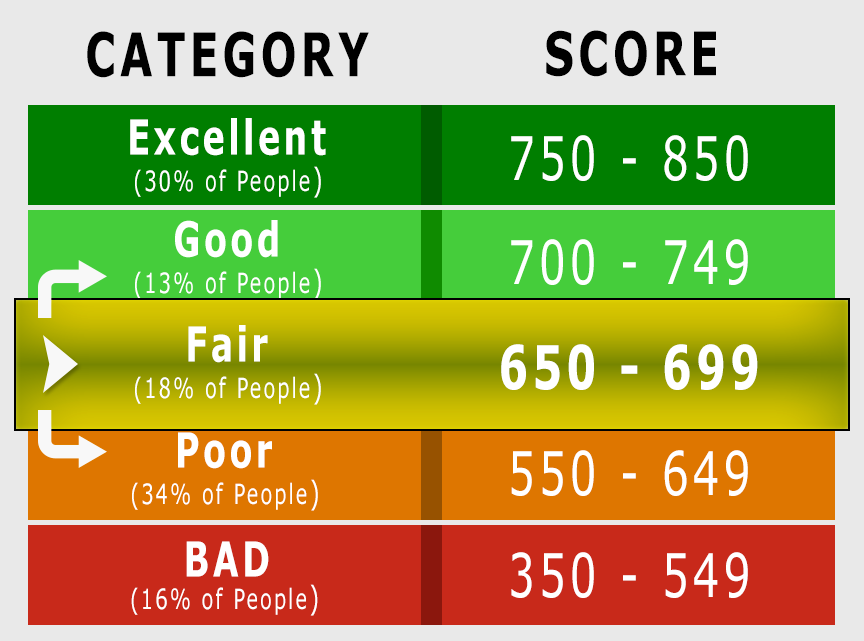

All manner of decisions are based off of your credit score and related scores. They can affect:

- Loan decisions

- Insurance coverages (Auto, Home, Umbrella, Small Business coverages, and maybe even Life)

- Rental and Leasing

- Employment

- And, at the outer edge, relationships.

Credit scoring is a subset of algorithmic scoring that is going on with greater frequency in our anonymous world today. To escape some of that, you can try setting up a relationship with a local community bank, smaller insurance companies, etc. They will treat you as more of a person, and less of a number. That said, it will likely cost more on average. Your mileage may vary.

What to do?

I decided to write this because I went through my own credit profile at one of the credit bureaus, and decided to try to correct some information that looked wrong. Now my credit score is fine, but what I was doing was in the nature of locking a door to your house where that door is never used.

I called up credit card companies to close credit cards that had not been used in years, a few of which I thought had been closed, but the credit report did not reflect that. Also one where it said there had been a dispute over the account. Oddly, that one was the easiest to deal with. They have now closed the account.

Now there are many sources of getting credit data on yourself. This is a non-exhaustive list:

- Credit monitoring from data breaches. I usually get enough of these that I rarely don’t have this credit data.

- Through third parties doing you a service as a part of a broader offering to ad some value. My example here is AAA, where they have thrown in credit monitoring as a service.

- From credit card companies themselves. My longest-dated credit card is from JPMorgan Chase, and they give me credit monitoring as well, and free access to my credit score. (Note: it is just one credit score. There are many of them and they are not identical, but typically they are highly similar.)

- Finally, available to EVERYONE — AnnualCreditReport.com.

Complete data, totally free, excluding credit scores, is available at AnnualCreditReport.com. You can get all three credit bureaus at once, or, you could do a different one every four months in order to keep a closer eye on your credit profile. They all have roughly the same data anyway — I have never seen a significant difference on my profile between the three. But then, I have no loans and few credit cards outstanding. I have deliberately kept things simple over my lifetime.

Look at your credit data for things that are wrong. Talk to the lenders to correct things, and if that doesn’t work, file statements with the credit bureaus to tell your side of the story. Close unused accounts, with the exception of your longest-standing account, which plays a role in your credit score. Credit scores give you more points for the length of your longest open credit account.

Practically, I keep two personal credit cards. One is the card offering the best deals to me in terms of money back, and the other is the backup card, which is the one that I have had the longest. I keep two cards because of the possibility of fraud on one of the cards. When fraud happens, a card gets cancelled and reissued. During that time where you wait for the reissue, a backup card is a big help; the convenience of using a card for deferred payment is considerable if you pay off the bill in full each month.

I review credit card charges once a month to check for fraud. I have a monthly “finances day” for my home and business, where I check my finances, and manage future cash flow. I review the overall credit profile two or three times a year. Most of the time it yields nothing, but it only takes five minutes unless something needs to be corrected.

As I often say here: you are your own best defender. But if you feel that you are in over your head, find a smart friend who is local to you and ask him for help.

Finally, keep enough liquid assets around to deal with moderate disasters. Build a buffer against common troubles. If you do these things, and have insurance against most common risks, you will survive better than most, and absolutely survive 99% of the time.