Issues Associated with the Current Election

Picture Credit: derek visser (modified to exclude extraneous comments) || Trump and Harris are more similar than different. Both favor the rich, they lie, they are for abortion and against immigration.

1) For those that follow my Twitter feed, you know that I don’t like Trump or Harris much. Trump has bad character and evil policies. Harris is an accidental candidate that initially sparked some excitement among Democrats, but has proven to be a low quality campaigner. Had Biden not sought re-election Harris would not have been the choice of the Democrats. She would have failed the same way she did in the 2020 primaries. She also has the baggage of having concealed Biden’s mental infirmity, when she should have invoked the 25th amendment as her duty. Other problems: Endorsing all the actions of the Biden administration. Also, a history of such a wide range of policy positions that you really don’t know what she stands for. Finally, she is a Democrat so she has evil policies as well.

For ethical reasons, I can’t vote for either of them. Since I live in Maryland, my vote doesn’t mean anything, anyway.

2) A while ago, I wrote a piece called NOTA Bene, and followed it with NOTA Bene, Redux. NOTA: None Of The Above. The idea is that “None Of The Above” would exist as a choice in every race, and if it wins, the election must be reheld, with none of the prior candidates allowed to run, and (in the more severe version) that none of the parties represented can nominate a candidate.

Think about it. The far left and far right would gain no advantage from running polarizing candidates, because they would lose to NOTA. We need to create a NOTA-type law or amendment to the Constitution. It ended the Soviet Union; it could end our lousy politics.

3) One other thing NOTA might help end is the “Purple Party.” The Purple Party governs America on behalf of the rich. Both Trump and Harris are part of the Purple Party. In general, the wealthy get what they want as result of the structure of the tax code. They pursue a global dominance policy that protects American and allied business interests, rather than the simpler concept of defense. They are the party of big government; the Republicans long ago forsook shrinking the government and the deficit. If we had more moderate conservatives, centrists, and moderate liberals in office, we might be able to work out some of the harder issues.

4) Fideism: “If I believe it, it is true.” We have more and more people engaging in wishful thinking. An example is Modern Monetary Theory, which I call Banana Republic Monetary Theory. There are no limits to borrowing? Tell that to Zimbabwe, Venezuela, Argentina, Turkey, and many other developing nations who borrowed far too much money and ruined their economies.

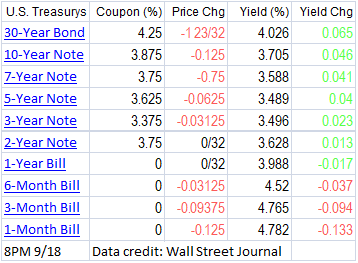

What makes the US different? Neither Harris nor Trump sees any reason to not expand the deficit further. For now, other countries want us to buy their goods, so they take in our government debts to make the books balance. But less and less of the world is doing so. Russia, China, and a few other nations are limiting their use of US dollars, and dollar-denominated debt.

Fideism is a Trump specialty. He makes up his own truth. The 2020 election was not stolen. The State GOP chairmen to a man in Arizona, Georgia, Pennsylvania, and Wisconsin all stated there was no election fraud to the degree of changing the results. If anything, the one trying to steal the election in 2020 was Trump. After losing, and being told by many of his subordinates that he lost, he did everything he could to change the result. It’s one thing to file lawsuits with hard evidence; it’s another thing to do it with vague allegations.

But fideism is across the political spectrum, amplified by the far right and far left media. They feed people what they would like to be true. Me? I read from the moderate right to the moderate left. I have a reasonably good idea of what those who disagree with me think. If you don’t understand your opponents, you probably don’t understand your own position so well.

5) And why not say, “Let us do evil that good may come”?—as we are slanderously reported and as some affirm that we say. Their condemnation is just. [Romans 3:8 NKJV]

I have some words for my fellow evangelical Christians here. Choosing the lesser of two evils is choosing to do evil. It is not copping out to say, “I am not playing this game.” Just write in NOTA on every race where the main choice is voting for the lesser of two evils. Voting for Trump or Harris is a sin.

Remember Jesus is King over all, sitting at the right hand of the Father in Heaven. God has already won, and this election is of no consequence to Him. He does care about what his Church is doing, and in supporting Trump, he sees the sins of the Church. We can engage in politics, but on Christian principles, not those of the Republican (now Trump Nationalist) Party.

It was good to fight for ending abortion on demand. Roe vs Wade was badly decided in 1973. This should have been worked out by the states. Many intelligent people thought the 1973 opinion was thought out badly. Even RBG thought that. But when the Supreme Court reversed Roe vs Wade, the predictable thing happened. Many states passed laws to allow abortion on demand, and many Republicans (who were always half-hearted about opposing abortion because it was only about keeping evangelicals and other religious people who opposed abortion in the GOP) abandoned the pro-life cause. It was now a vote-loser.

Christians, you did your best, but the culture of America has changed. We are a much more cruel society than we once were. Abortion is cruel, killing the weakest of people in their mother’s womb.

But America is cruel in another way. My ancestors came to America when immigration was lightly regulated. They would refuse those who were diseased, and exile immigrants that committed felonies. Why do I have the right to live here, and those who want to get away from oppressive governments don’t?

I favor of the relatively free immigration that existed before the Protestants acted to keep Roman Catholics, and those of other religions out. Those who come to US fleeing persecution now get locked up in US jails with fewer rights than felons, and the grand majority of them get deported back the country from which they fled. Who is to blame for this? Trump, Biden and Harris, and their parties.

It is a myth that immigrants take jobs away from others. If anything, they create jobs. The jobs they do most Americans don’t want to do. And, many of them build their own businesses, employing others. The skills that it takes to flee your home country and get to America are similar to those that you need to run a business. You have to be flexible, adapt, and be determined to achieve your goal.

The Bible teaches us fifteen times that we are supposed to take care of the widow, orphan, and stranger. Turning away people who are seeking to live safely in the US is cruel. Yes, if someone is known to be a spy, or commits a felony, exile them.

Christians, also remember that Leviticus 24:22 says, “You shall have the same law for the stranger and for one from your own country; for I am the LORD your God.” To that end, either immigrants get access to welfare programs, or we end those programs for everyone. America should be the beacon of freedom to the world that it was back in the late 19th century.

Conclusion

Today I go to the polls and vote. I will be writing in NOTA a bunch of times. I will vote against the proposal to enshrine abortion in the Maryland Constitution. Will it matter? Yes. God is watching me. That is what matters.