If businesses anticipate a flow of financing, they will depend on it.? Then a diminution or increase in the flow of investable funds will affect markets, even if the flow of investable funds remains positive or negative.

Most of the sayings from the “rules” posts came from things I thought of while managing investment risk 1998-2004.? I think I wrote this one late in 2002, or early 2003.? I’ll apply this three ways — what I would apply this to now, then, and in-between.

Then: the Fed funds rate was below 2%, and the yield curve was steeply sloped.? The corporate bond market had gone through an incredible bust, but almost all the companies that would fail had already failed, and a big rally was just starting.? Banks were still in good shape, with plenty of lending capacity, which was being applied to residential and commercial lending.? The securitization markets functioned and financing was easily available for residential & commercial mortgages, and many types of consumer lending.

In-between (1): Now I’m talking about 2006-7.? Fed funds rate was rising to an eventual 5.5%.? The curve is flat to inverted, and corporate spreads are very tight.? Issuance of low grade paper is rampant, and covenant protections are declining.? Risk is chasing reward, and gaining.? Everything is overlevered.? Any attempts at prudence are financially punished.? That said, the securitization market slows; deal are harder to do.

In-between (2): Now I am talking about late 2008 to early 2009.? Fed Funds had shifted to its current near zero state, but the Fed had not begun playing with the asset side of its balance sheet.? The yield curve was relatively wide but bull flattening.? Nothing was getting done in lending, and credit spreads were as wide as wide can be.? Securitization drops to near zero. Bank lending is non-existent, aside from buying Treasuries on credit provided by the Fed.

Now: The Fed funds rate is still in the gutter, and the Fed dreams that QE will do a lot for the economy.? (It works in theory! Stupid economists.)? Corporate credit spreads are wide, covenant protections are low, and yields relative to intrinsic risk are low.? Securitization markets are functioning at a reduced level, while banks aren’t lending much to the private sector.? Most housing loans are backed by the US government.

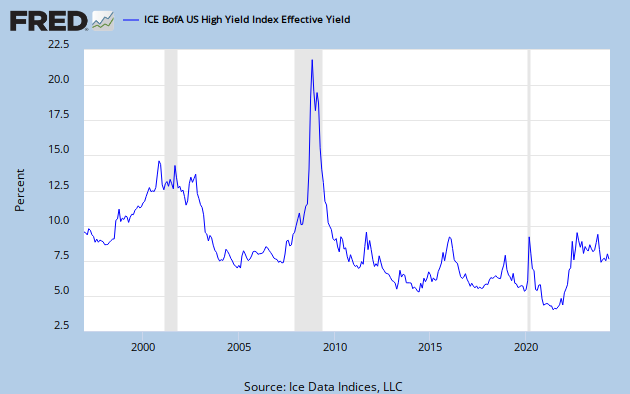

So here is the graph:

The point of this piece is to tell you not to look at the level of risky interest rates, but to look at the rate of change in risky interest rates. It tells a lot regarding future prospects of the stock and bond markets.? The rate of change matters a great deal, not the absolute level of rates.

So, the implication is watch for a sustained rise in in high-yield bond yields.? When those yields cross their 10-month moving average, it is time to be gone from risk assets.

4 thoughts on “The Rules, Part XLI”