Okay, time to roll the promoted stocks scoreboard:

| Ticker | Date of Article | Price @ Article | Price @ 12/30/13 | Decline | Annualized | Splits |

| GTXO |

5/27/2008 |

2.45 |

0.009 |

-99.6% |

-63.2% |

|

| BONZ |

10/22/2009 |

0.35 |

0.001 |

-99.7% |

-74.2% |

|

| BONU |

10/22/2009 |

0.89 |

0.001 |

-99.8% |

-78.6% |

|

| UTOG |

3/30/2011 |

1.55 |

0.002 |

-99.9% |

-91.1% |

|

| OBJE |

4/29/2011 |

116.00 |

0.230 |

-99.8% |

-90.3% |

1:40 |

| LSTG |

10/5/2011 |

1.12 |

0.012 |

-98.9% |

-86.9% |

|

| AERN |

10/5/2011 |

0.0770 |

0.0001 |

-99.9% |

-94.9% |

|

| IRYS |

3/15/2012 |

0.261 |

0.000 |

-100.0% |

-100.0% |

Dead |

| RCGP |

3/22/2012 |

1.47 |

0.140 |

-90.5% |

-73.4% |

|

| STVF |

3/28/2012 |

3.24 |

0.430 |

-86.7% |

-68.3% |

|

| CRCL |

5/1/2012 |

2.22 |

0.024 |

-98.9% |

-93.5% |

|

| ORYN |

5/30/2012 |

0.93 |

0.030 |

-96.8% |

-88.5% |

|

| BRFH |

5/30/2012 |

1.16 |

0.610 |

-47.4% |

-33.3% |

|

| LUXR |

6/12/2012 |

1.59 |

0.012 |

-99.2% |

-95.7% |

|

| IMSC |

7/9/2012 |

1.5 |

0.850 |

-43.3% |

-31.9% |

|

| DIDG |

7/18/2012 |

0.65 |

0.053 |

-91.8% |

-82.2% |

|

| GRPH |

11/30/2012 |

0.8715 |

0.024 |

-97.3% |

-96.4% |

|

| IMNG |

12/4/2012 |

0.76 |

0.050 |

-93.4% |

-92.1% |

|

| ECAU |

1/24/2013 |

1.42 |

0.248 |

-82.5% |

-84.7% |

|

| DPHS |

6/3/2013 |

0.59 |

0.006 |

-99.0% |

-100.0% |

|

| POLR |

6/10/2013 |

5.75 |

0.050 |

-99.1% |

-100.0% |

|

| NORX |

6/11/2013 |

0.91 |

0.096 |

-89.5% |

-98.3% |

|

| ARTH |

7/11/2013 |

1.24 |

0.290 |

-76.6% |

-95.4% |

|

| NAMG |

7/25/2013 |

0.85 |

0.290 |

-65.9% |

-91.7% |

|

| MDDD |

12/9/2013 |

0.79 |

0.480 |

-39.2% |

-100.0% |

|

|

12/30/2013 |

Median |

-97.3% |

-91.1% |

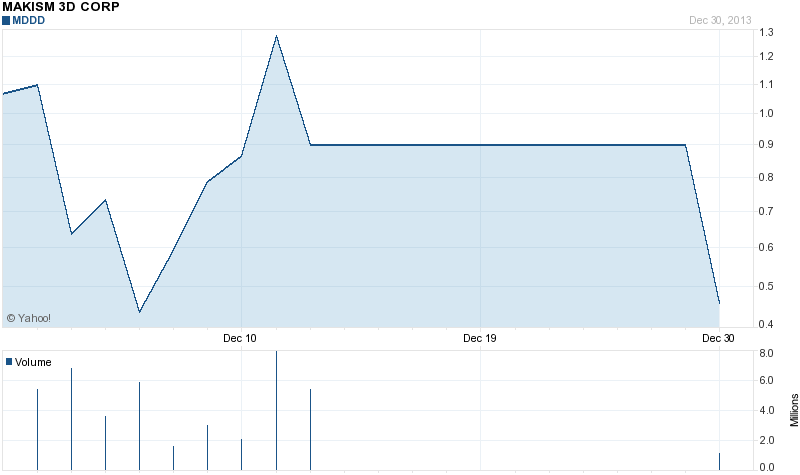

Before I talk about tonight’s loser-in-waiting, let me tell you what happened to Makism3D, the last company I reviewed.? Four days after I reviewed it, the SEC suspended trading, and it reopened on 12/30, falling 49% on the day.? Dig the price graph:

The SEC is getting more aggressive about suspending trading in companies that are being promoted.? Some suggest that publishing pieces like this, or others at Seeking Alpha, is encouraging the SEC to be more bold.? If true, that is good.

Now for our loser-in-waiting — Tiger Oil & Gas [TGRO].? I ran into TGRO via an ad on Bloomberg.com.? It led me to this spammy article, which led me to this even more spammy article.? If I were invests.com, I would be more protective of my reputation.? I get all sorts of requests to publish low quality articles at Aleph Blog, maybe 50 per month.? You can make money doing that in the short run, but I never want to treat my readers in such a bad way.

And if I were Bloomberg.com, I would not let them advertise.? Because I write these articles, sadly, I get ads for them, but if I see those ads, I tell my ad network to stop running them.

TGRO is another company that has no revenues, negative income, and negative net worth.? Sound familiar?? Maybe Congress should ban “development stage companies.”? I’ve never seen one that was worth anything.

Here is the beginning of the disclaimer:

This report is for informational purposes only, and does not represent a solicitation to buy or sell the profiled company?s securities, which trade under the symbol TGRO, nor any other securities. StockTips.com is operated by Amerada Corp. (AC). Neither AC nor its employees are certified financial analysts or licensed in the securities industry in any manner. The information in this marketing piece and any accompanying information is subjective opinion and may not be complete, accurate or current and was paid for directly or indirectly by shareholders of the profiled company who may or will profit as a result of the preparation, publication and distribution of this marketing piece and accompanying information. AC expects to receive $2,500,000.00 (TWO MILLION FIVE HUNDRED THOUSAND DOLLARS) as a marketing budget for production and distribution of TGRO marketing material from an unaffiliated 3rd party, Laluna Services, Inc.

And that is what paid Bloomberg.com to give them the top link on a box to the side.? The amount paid is 5% of the present market cap, but 30% of the market cap prior to the promotion.? Look at the price graph:

I should add that this was a operating chemicals company 2007-2010, and another development stage company prior to that.? Such behavior where a company is in the development stage indicates that there is little if any underlying business, and that it is merely a machine to suck money out of the pockets of naive investors, and into the pockets of promoters and insiders.

As I often say, “Don’t buy what someone wants to sell you.? Buy what you have researched and think is valuable.”? Particularly with intangible items like stocks, those who are directly paid to promote stocks are almost always scammers.

Avoid promoted stocks.