The Best of the Aleph Blog, Part 36

====================

In my view, these were my best posts written between November 2015 and January?2016:

Don?t be a Miser in Retirement (Or Ever)

It is possible to over-save, and underspend.? You should leave some inheritance for your heirs, but don’t deprive yourself of the benefits that having some assets provides.

In general it is better to take payments over time than to receive it as a lump sum.? If you do have a lump sum that comes to you, take care not to spend it too rapidly.

On Currencies that are Not a Store of Value

How would you live if you were trapped in Venezuela, Turkey, Zimbabwe, or some other badly run country with high inflation.? Here are a few bits of advice.

How do you figure out how much expenses you need to fund, and as a result, how much you have to grow your assets to fund those expenses.

Ten Questions and Answers on ETFs and Other Topics

This was from a survey of bloggers on basic questions to answer for young people.

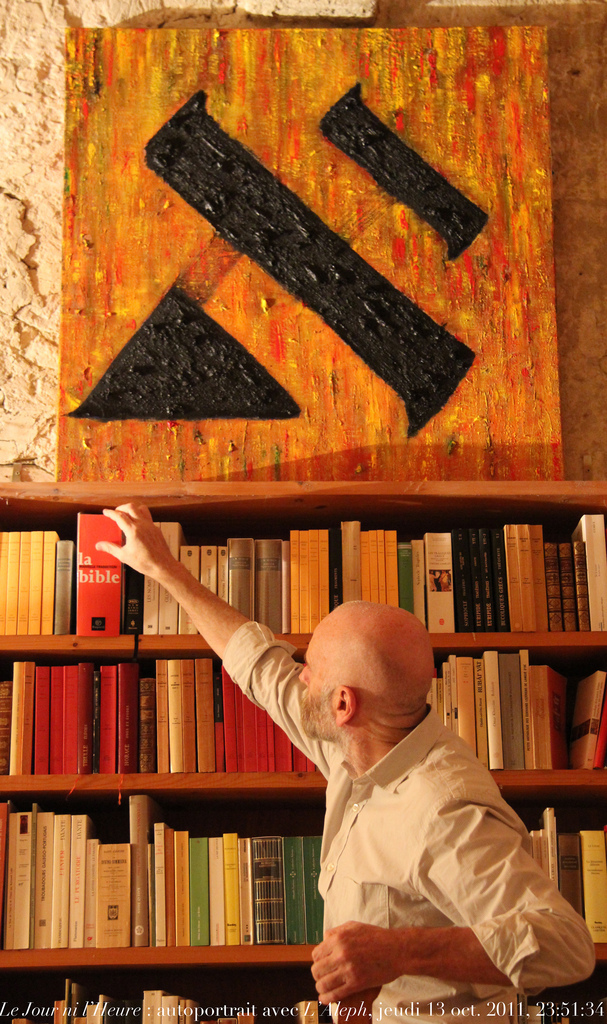

Ten Investing Books to Consider

Good books on value investing, markets, and risk.

We Eat Dollar Weighted Returns ? VII

Truly gruesome.? What’s the difference between what a buy-and-hold investor earned on Ken Heebner’s main fund versus what the average investor earned on the fund?? Really, it’s astounding.

The Limits of Risky Asset Diversification

Over time, all classes of risky assets tend to become correlated with each other.? This is because investors naively diversify their risky assets across these classes, and then engage in panic selling behavior with all of these classes as a group.

How Much is that Asset in the Window? (III)

What is the value of a fund that you can’t get money out of?

Direction Matters More Than Position with Monetary Policy

As the yield curve steepens, more investment opportunities become uneconomic.? Don’t say that monetary policy is accommodative when you are tightening.

There are always new freaky ideas in finance that will likely not become common.? This is one of them.

Annotated ?In Hoc Anno Domini?

Response to ?In Hoc Anno Domini?

At Christmas, the Wall Street Journal republishes a vacuous opinion piece by Vermont Royster that is little better than liberation theology for conservatives.? He twists Scripture out its contexts to make it mean what is never meant.? Bogus beyond measure.