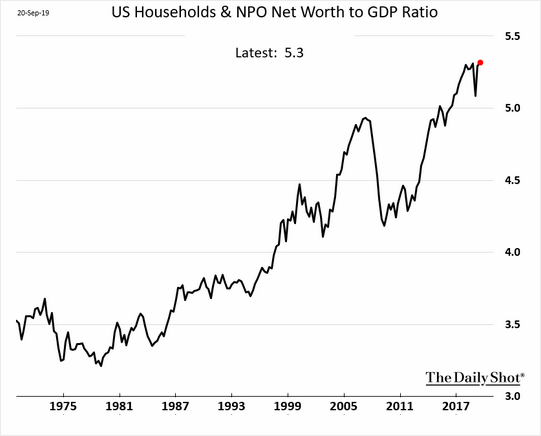

Here’s a graph from @soberlook, who blogs The Daily Shot at the Wall Street Journal:

What I am going to write resembles my recent article Estimating Future Stock Returns, June 2019 Update. How much does the ratio of imputed US household net worth to GDP matter? More is better, right?

It depends who you ask. If you ask someone who is likely to be drawing on capital, he would probably be happy about it. The assets are worth a lot relative to the income that they generate. That sounds very good, but it is really only a little good. In my opinion, one of the better articles I have written was called From Stream to Shining Stream. In it I tackled the idea that the market’s level doesn’t matter much. It’s a good read, and timeless, but here is one quotation from it:

Remember when I said:

You don?t benefit much from a general rise in values from the stock or bond markets. ?The value of your portfolio may have risen, but at the cost of lower future opportunities.That goes double in the distribution phase. The objective is to convert assets into a stream of income. ?If interest rates are low, as they are now, safe income will be low. ?The same applies to stocks (and things like them) trading at high multiples regardless of what dividends they pay.

From Stream to Shining Stream at Aleph Blog

But now ask some of my children who are thinking of buying houses in the next few years. To them, prices seem sky-high, even as financing rates seem low. Baltimore may have severe issues in some areas, but the areas outside of it are generally pretty nice, particularly on the DC side of Baltimore.

Now, part of that is local. Places where there aren’t many homes to buy, largely due to zoning in this case, but other cases land scarcity, the price of housing has risen In cold markets in the center of the US, that wouldn’t be a big problem… the cost of a mortgage payment today is similar to that 20 years ago. Still, for those paying a higher price, even if the periodic financing cost isn’t much higher, they presume on their ability to finance the debt.

Before I move to my conclusion, note that debt doesn’t directly figure into the above graph. Debts are an asset to the lender, and a liability to the debtor. It nets to zero. That said, an indirect effect is possible. If new debtors are willing to borrow more aggressively, putting less money down, then housing prices will rise, and so will implied rents, and estimated net worth. Perhaps if we calculated the present value of unencumbered future wages the effect on net worth would be zero again, but that figure would be even more of a mess than most housing related items like implied rent and the value of the housing stock.

Conclusion

The graph of the ratio of imputed US household net worth to GDP is more of a statement about the low cost of capital than it is a statement of improved economic prospects in the US. GDP does a better job of explaining how much the economy has improved. GDP as a calculation has many issues, but this total net worth calculation has more. It is easier to measure the cash that flows than it is to estimate the values of all assets, many of which do not trade on a regular basis.

Should the cost of capital revert to higher levels — higher corporate bond rates, higher mortgage rates, lower price-earnings multiples, lower capitalization rates on real estate, private corporations, etc., we would see most of the increase in the ratio of imputed US household net worth to GDP disappear.

Thus, if you don’t feel all that much better off when you hear about rising US household net worth, you are not irrational. You have a lot of company.

One thought on “How High Can Markets Fly?”