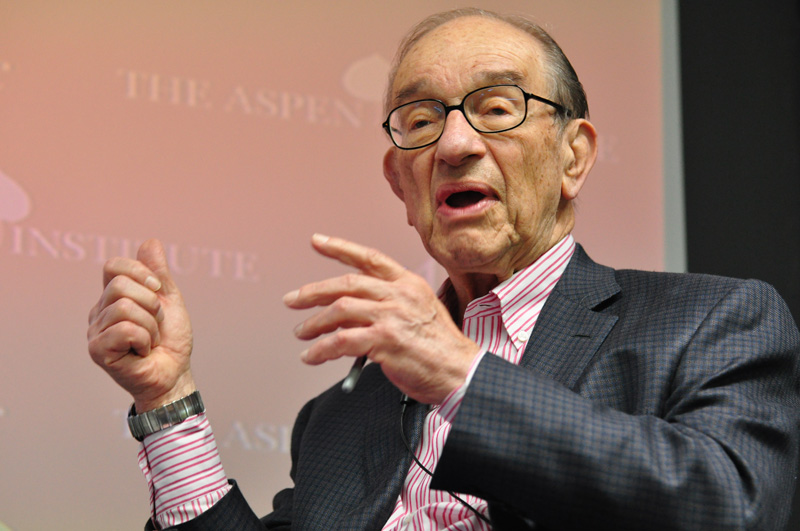

Photo Credit: The Aspen Institute || His shadow still affects central banking today…

At Aleph Blog, I will argue for things that are against my short term interests. After all, the higher stock and bond prices go, the higher my income goes in the short-run. In the long-run, that’s not sustainable.

I am here this evening to criticize the philosophy of Alan Greenspan that had the FOMC doing the bidding of the stock, bond, and futures markets.

- Don’t disappoint the markets.

- Give the markets what they want, and everything will work out well.

- Flag the markets to tell what your intentions are.

None of those are the province of the Fed. The Fed is supposed to care for:

- Low inflation

- Low labor unemployment

- Moderate long-term interest rates

- (and indirectly) A healthy banking system, because the levers of Fed policy depend on it.

All of these things are going well at present, AND the yield curve has normalized. So why loosen again? Well, Fed funds futures indicate a igh probability of a cut… so give the market what it wants, right?

Ah, bring back Volcker and Martin, who would follow their statutory mandate, and not just mention it to excuse policy errors.

I write this partly after reading this article at Marketwatch. The article is a mix of different opinions, but the ones that get me are the ones that say that the Fed has to listen to the markets.

Well, that’s what Greenspan, Bernanke, and Yellen did, and it led us into a low interest rate morass because they never let recessions do their work and eliminate entities with low marginal efficiencies of capital.

Recessions are not always bad, and lower interest rates are not always good. Just as fires are good for forests in the long run, so are recessions that clear away marginal economic ideas.

It may not come this week. It may not come in the next few years, but eventually the Fed will be willing to offend the markets again. When it does, the jolts will be considerable, but it may lead to a better economy in the long-term.

Yes, mild/normal recessions are good!

Thanks for your blog.