Thoughts on my Last Two Posts

Some follow-up on my last two posts.? I will be talking to those that suggested parties that would be willing to create a definitive bond blog.? But, others brought up a good point, which I am well aware of, but forgot for a moment.? The bond markets are mainly institutional.? Institutional bond investors have no lack of research sources to guide them.? Retail investors get ripped of, or are relegated to government bonds, ETFs, or mutual funds.? So, maybe creating a definitive bond blog would not be a good use of time?? Maybe, maybe not.

What is clear is that such a blog would have to be retail-focused.? It could not dwell on minutiae that would be valuable to institutional investors, but would have to deal with the hard problems that retail investors face with fixed income.

The alternative would be to try to do a blog for institutional investors and bright amateurs, and invite institutional investors to write pseudonymously — think of it as a Zero Hedge for fixed income, without so much attitude.? But would institutional investors read it?? They are inundated already.

Now, John Jansen himself has encouraged the idea, which I appreciate.? He did great work while he was at it.? Could we do as well or better?

Thoughts?? I am still game for this idea, write to me here.

=–=-==–==-=–==-=–=-=-=-=-==–==-=-=-=-=-=-=–=

How long to the point of no return?? I don’t know.? In all of the time that I wrote at RealMoney, I tried to point at directions, but not give timetables.? Giving timing is a mug’s game.

But let me consider some of the commentary that I have received.? My last two posts generated so much traffic that people were not able to access my site for a time.

Promises, promises.? What is a promise to pay worth?? All I know is that the more promises there are outstanding, the less a promise is worth.? The same applies to the Federal Reserve, who issues small-denomination short-duration 0% CP, otherwise known as currency.

Some say that so long as a primary dealer can “repo previously issued govt bonds at the central bank to gain reserves to purchase the new issue bonds at a Treasury auction, that nation can never default, no matter what the level of debt to GDP ratio is….” The effect of that is to raise interest rates.? Higher rates will harm the economy.? As more long-term promises are issued, the safety/value of a promise diminishes.? The same is true of short-term promises, but the effect is more immediate.

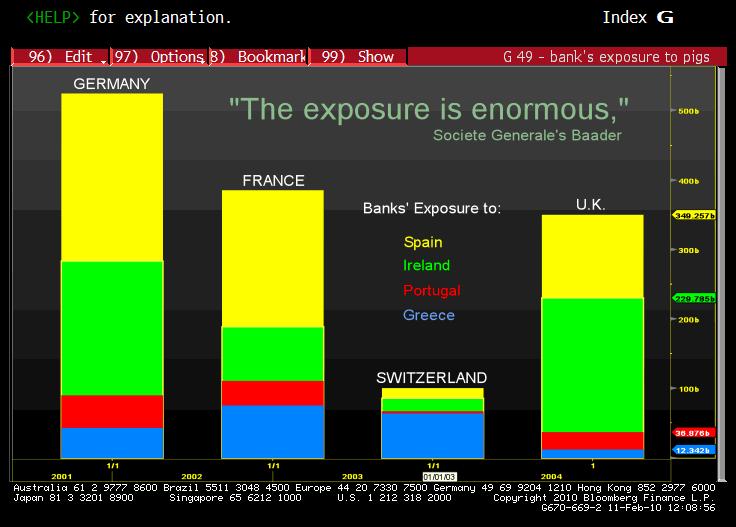

Which reminds me that nations with a lot of debt to roll over are most at risk.? There are others in worse shape than the US.? The US Dollar may be the best among bad major currencies, as I have argued on many occasions.? Also, banking crises tend to lead to sovereign debt crises.? The nation absorbs the losses of the banks, and then some fail as a result.

In a true free market, no one would care about currency levels.? They would take spot and future currency rates and factor them in as a cost of doing business.

The Keynesian solutions assume that growth will occur as a result of government spending.? I disagree.? In Japan, there has been no end of such spending, and from what I have read, that spending has not resulted in additional productivity.? Additional productivity only comes from projects that yield more benefits than their costs, and Japan has had more than its share of white elephants.

Throwing a brick through the window and having the glass repairman do his work may raise GDP, but the net worth of society is diminished.? True growth comes from entrepreneurs competing for advantage, and finding places where there are needs to be met.

That is one reason why I say that the deficit spending of the US is destructive.? It does not reflect the needs of people, but the needs of politicians currying favor with interest groups.? We need to shrink the US Government, so that it cannot meddle with the details of our lives.? Let it focus on defense, justice, internal security, and public health, goals worthy of a government.? Let local governments deal with other issues.

The budget troubles will percolate down to all municipalities.? It cannot be otherwise.? Local governments will toss out less needed actors, such as social workers, and retain those more needed, like policemen.? On the whole, society will be better off, as we reduce unproductive actors.

Growth matters a lot.? We need to focus on eliminating things that constrain the growth of the economy, without sending the government budget into greater deficit.? Let the US government reduce corporate welfare.? Let them eliminate the deduction for employee health care expense — that will shrink the health care sector significantly.? My view is that we need to eliminate all tax preferences in the economy, and tax people/institutions in their increase in value every year.? Get the government out of the social engineering business.? Let’s have true tax reform.? Let government do what it does well, and leave the rest to the people.

I recognize that I have a point of view here.? My contention is (aside from ethical issues) that when there is a high level of debt in an economy, that efforts to stimulate fail.? Better not to stimulate at all, ever.? Rather, focus on constraining credit, so that speculation does not overcome the economy, whether personal or corporate.

As for now, let us encourage short sales, foreclosures and bankruptcies, which eliminate debt.? Prices will reset lower, but predominantly equity-financed businesses will not fail easily.? Once the Debt/GDP ratio gets below 1.5x, the economy will grow on a healthy basis again.