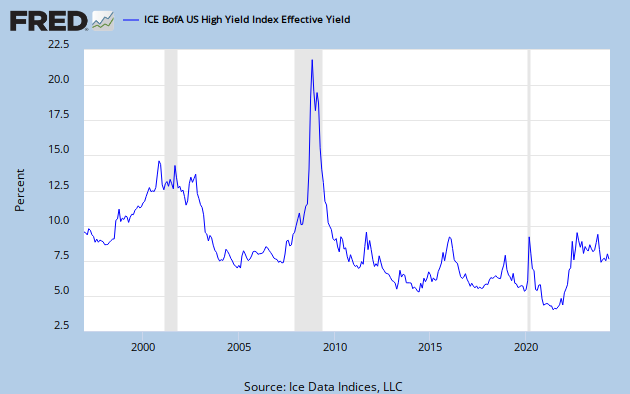

What does it take to create a global or national financial crisis?? Not just a few defaults here and there, but a real crisis, where you wonder whether the system is going to hold together or not.

I will tell you what it takes.? It takes a significant minority of financial players that have financed long-dated risky assets (which are typically illiquid), with short-dated financing.

The short-dated financing needs to be rolled over frequently, and during a time of financial stress, that financing disappears, particularly when creditors distrust the value of the assets.? It typically happens to all of the firms with weak liability structures at the same time.

During good times financing short is cheap.? Locking in long funding is costly, but safe.? That is why many financial firms accept the asset-liability mismatch — they want to make more money in the short-run in the bull phase of the market.? But when many parties have financed long risky assets with loans that need to be renewed in the short-term, the effect on the markets is multiplied.? The value of the risky assets falls more because many of the holders have a weak ability to hold the assets.? Where will the new buyers with sound finances come from?

Areas of Short-dated Financing

Short-dated financing is epitomized by bank deposits prior? to the Great Depression.? If doubt grew about the ability of a bank to pay off its depositors, depositors would run to get their cash out of the bank.? Deposits are supposed to be available with little delay.? After creation of the FDIC, deposits under the insurance limit are sticky, because people believe the government stands behind them.

But there are other areas where short-dated financing plays a significant role:

- Margin accounts, whether for derivatives, securities, securities lending, etc.? If a financial company is required to put up more capital during a time of financial stress, they may find that they can’t do it, and declare bankruptcy.? This can also apply to some securities lending agreements if unusual collateral is used, as happened to AIG’s domestic life subsidiaries.

- Putable financing, particularly that which is putable on credit downgrade.? This has happened in the last 25 years with life insurers [GICs used for money market funds], P&C reinsurers, and utilities.? Now this is similar to margin agreements on credit downgrades because more capital must be posted.? Anytime a credit rating affects cash flows, it is a dangerous thing.? The downgrade exacerbates the credit stress.? Then again, why were you dancing near the cliff that you created?

- Repo financing was a large part of the crisis.? The weakest large investment banks relied on short-term finance for their assets in inventory.? So did many mortgage REITs.? As repo haircuts rose, undercapitalized players had to sell, lowering asset prices, leading to a new round of selling, and higher repo haircuts.? It was the equivalent of a bank run and only the strongest survived.

- Auction-rate preferreds — a stable business for so long, but when creditworthiness became a question, the whole thing fell apart.

- Finance companies — GE Finance and other finance companies rely on a certain amount of short-term finance via commercial paper.? It is difficult to be significantly profitable without that.

- All other short-term interbank lending.

Crises happen when there is a call for cash, and it cannot be paid because there are not enough liquid assets to make payment, and illiquid assets are under stress, such that one would not want to sell them.? This has to happen to a lot of companies at the same time, such that the creditworthiness of some moderately-well capitalized institutions, that were thought to have adequate liquidity are called into question.

The Value of a Long Liability Structure

Let me give a counterexample to show what would be a hard sort of company to kill.? In the mid-1980s, a number of long-tailed P&C reinsurers found their claims experience in a number of their lines to be ticking up dramatically.? But the claims take a long time to settle, so there was no immediate call for cash.? Later analysis showed that for many of the companies, if the full value of the claims that eventually developed were charged in the year the business was written, many of them would have had negative net worth.? As it was, most of them suffered sub-par profitability, losing money on the insurance, and making a little more than that on their investments.

But they survived.? Other insurers cut some corners in the ’90s & ’00s and wrote policies that were putable if their credit was downgraded.? This would supposedly give more protection to those buying insurance or GICs [Guaranteed Investment Contracts] from them.? Instead, the reverse would happen when the downgrade came — there would be an immediate call on cash that could not be met, and the company would be insolvent.? Even if the majority of the liability structure is long, if a significant part of it was short, or could move from long to short, that’s enough to set the company up for a liquidity crisis of its own design.

Credit cycles come and go.? The financial companies in the greatest danger are the ones that have to renew a significant amount of their financing during a crisis.? It’s not as if firms with long liabilities don’t face credit risk; they face credit risk, and sometimes they go insolvent.? But they have the virtue of time, which can heal many wounds, even financial wounds.? If they die, it will be long and drawn out, and they will hold options to influence the reorganization of the firm.? Creditors may be willing to cut a deal if it would accelerate the workout, or, they might be willing to extend the liability further, in exchange for another concession.

In any case, not having to refinance in a crisis makes a financial company immune from the crisis, leaving aside the regulators who may decide the regulated subsidiaries are insolvent.? But, the regulators may decide they have more pressing issues in a crisis from firms that can’t pay all their bills now.

AIG, Prudential & GE Capital

So the Financial Stability Oversight Council [FSOC] has designated AIG, Prudential & GE Capital as systemically important.? They are certainly big companies in their industries, but are they 1) likely to be insolvent during a credit crisis, and 2) does the failure of any one of them affect the solvency of other financial firms?

That might be true for GE Capital.? They certainly still borrow enough enough in the commercial paper market, though not as much as they used to.? If GE Capital failed, a lot of money market funds would break the buck.

AIG?? The current CEO says he doesn’t mind being being systemically important.? Still, Financial Products is considerably smaller than it was before the crisis, they aren’t doing the same foolish things in securities lending that they were prior to the crisis, and they don’t have much short-term debt at all.? The liabilities of AIG as a whole are relatively long.? And even if AIG were to go down, we shouldn’t care that much, because the regulated subsidiaries would still be solvent.? Financial holding companies are by their nature risky, and regulators should not care if they go bust.

But Prudential?? There’s little short term debt, and future maturities are piddling on long term debt.? If the holding company failed, I can’t imagine that the creditors would lose much on the $27B of debt, nor would it cause a chain reaction among other financial companies.

I feel the same way about Metlife; both companies have long liabilities, and would have little difficulty with financing their way through a crisis.? Just slow down business, and free cash appears in the subsidiaries.

I can make a case that of these four, only GE Capital poses any systemic risk, though I would have to do more work on AIG Financial Products to be sure.? But what the selection of companies says to me was it was mostly a function of size, and maybe complexity.? Crises occur because a large number of financial companies finance long-dated assets with short-dated borrowings.? I think the FSOC would have done better to look at all of the ways short-term finance makes its way into financial companies, and then stress test the ability to withstand a liquidity shock.

My belief is that if you did that, almost no insurers would be on such a list; the levels of stress testing already required by the states exceed what FSOC is doing.