Before I start this evening, I want to say something about many investment books that I have been reading of late. ?In terms of information toward the stated goal of the book, there is often a lot of build up, some of it necessary, some not, some of it interesting, some not, occasionally some unique insights, but most of the time not. ?Much of it is filler that could be eliminated. ?And, if you eliminated the filler, and boiled down the part of the book that attempts to prove the stated goal, you would have something the size of a long-form blog post. ?That’s why there is the filler — you would have a hard time selling a single chapter book, even though that contains the real value of the book, and would save your reader the time of wading through filler material.

Also, when I review books, I read them in entire. ?If I don’t read them in entire, I state that plainly at the beginning of the review, along with why I thought I could review the book without reading it. ?But after some of the books I have read lately, editing to condense the volume and stick to the topic at hand would be a help.

Finally, if the author doesn’t prove his case in an ironclad way, maybe the book shouldn’t be written. ?I often get to the end of a book disappointed, because the author promised a significant result, and did not deliver.

Onto tonight’s topic:

When is the best time to invest? ?When everyone else is scared to death of investing. ?It’s when friends come up to you and say, “I’m never investing in stocks ever again.” ?When the magazine covers proclaim “The Death of Equities,” it is time to invest.

Guess what? ?Very few people do invest then. ?It’s too painful to contemplate throwing away your money when nothing is going right, and losses are cascading. ?Remember, we are not rational, we are mimics.

When do people like to invest? ?When it’s popular to do so. When prices have been rising for a while, and the lure of “free money” is in the air. ?Books on easy money flipping homes proliferate, and there is a brisk business in seminars teaching an easy road to riches. ?It’s that time when people say, “Let the market pay your employees.”

I’ve talked about the fear/greed cycle many times before. ?I’ve also talked about time-weighted vs dollar-weighted returns before. I’ve talked about vintage years in lending before, and about absolute return investors before. ?I’ve talked about industry rotation before, as well as long-term mean reversion. ?These are all manifestations of the same phenomenon in investing — it is best to invest in any given area when few are doing so, and worst to invest when almost all are doing so.

Let me give a bunch of parallel examples to make this clear.

Why do great mutual fund managers cease to be great? ?When they are great, they have less money to manage than their ideas could bear managing. ?But money follows performance because we are not rational, we mimic. ?Eventually enough money comes in ?such that the talented investor no longer has good places to put incremental money, and can’t just leave some of the money in cash, or an index fund… from a business angle, it would not fly.

Lest you think that this does not happen to passive investing, money follows performance there also. ?It also happens in open-ended index funds, ETPs, and closed-end funds of any sort (expressed through the premium or discount).

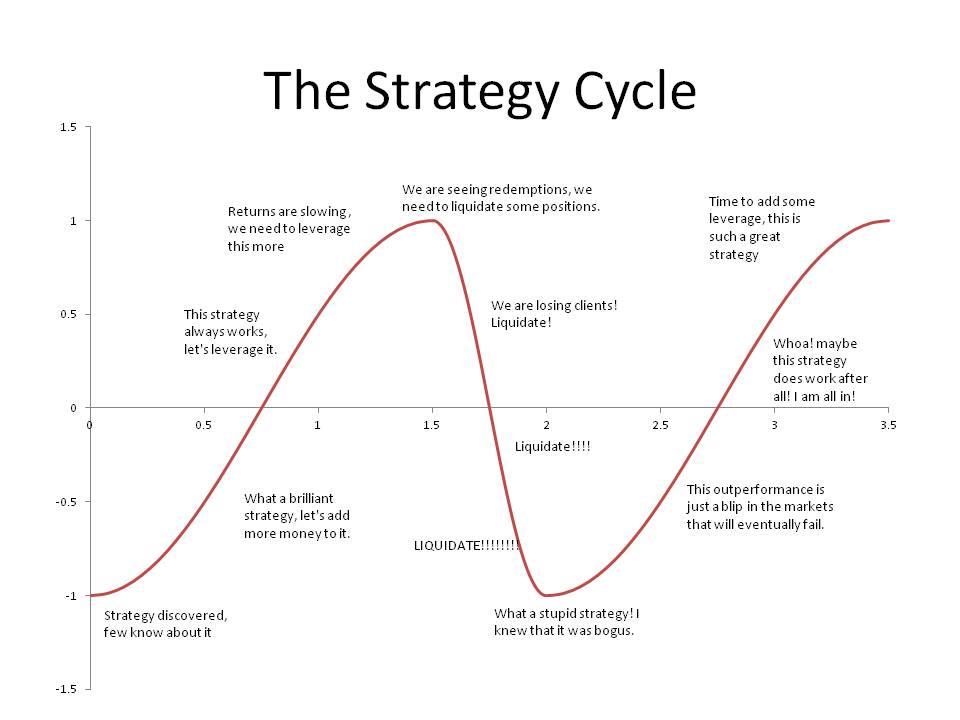

This also applies to quantitative investment strategies — even those with broad themes like momentum and valuation. ?Let me illustrate this with a slide from a presentation I have done before a large CFA Society:

And this applies to lending whether securitized or direct. ?When money is being thrown at a sub-asset class, like subprime RMBS in 2006-7, or manufactured housing ABS in 2000-1, the results are bad. ?The best results occur when few are lending, and only the best deals are getting done. ?But that means that few get those high returns. ?That is the nature of the markets.

The same applies to corporate bonds. ?It is wise to avoid the area of the market where issuance is well above average. ?When I was a corporate bond manager, I sold out my auto bonds, and my questionable telecom bonds, amidst much issuance. ?I had many brokers puzzle over why I would not buy their deals, even though they were cheap relative to their ratings.

The same applies to private equity. ?When a lot of money is being applied there, it is a time to avoid it. ?As it is now, private equity is throwing money at promising companies, many of which hold onto the money for safety purposes, because they don’t have place to invest it. ?That doesn’t sound promising for future returns.

Finally, we have a few absolute return investors like?Klarman, Grantham, and Buffett. ?They are reducing allocations to risk assets, at least in relative terms. ?Opportunities are not as great, and so they wait.

Summary

The intelligent investor estimates likely returns, and invests if the returns are worth the risk. ?I am reducing my risk positions, slowly, as I see best for my clients and me.

Most profitable investing takes an uncomfortable view versus the consensus, and buys when the market offers good deals. ?If there are no good deals, profitable investing sits on cash, and waits for a better day.

4 thoughts on “Why it is Hard to Win in Investing”