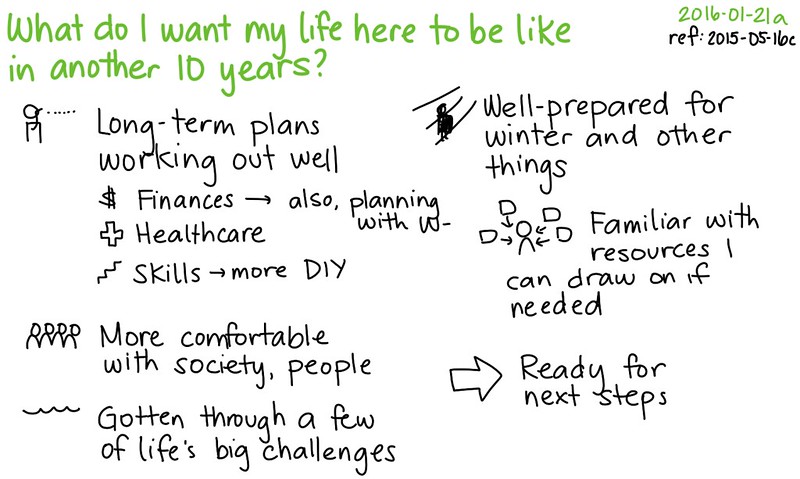

Photo Credit: Sacha Chua || Planning is a good thing.

In any investment decisions, one must look at the long term. Don’t pay any attention to news that does not permanently change business conditions.

The thing that drew my attention here is the rather weak coronavirus. Stalin supposedly said, “A single death is a tragedy; a million deaths is a statistic.” My sympathies to the families of those who have died from the coronavirus. But to society as a whole, the coronavirus has done less damage than influenza does every year.

As such, I don’t pay attention to the coronavirus. Stocks are long-term assets, and if the coronavirus will have no impact on the economy past 2025, I don’t see why I need to pay attention to it.

The same applies to politics. Is there someone coming like Chavez or Maduro who will radically reshape business/industry? No? Well, don’t worry so much. Money votes for itself. Few genuinely want to slay the processes that make society well-off in aggregate, even if they are getting a lesser portion of the increase.

In healthy societies, there is a tendency to protect property rights. Property rights are an aspect of human rights, let the liberals note this. We can argue about the edges of the rights, but fundamentally property rights must be protected, or society falls apart.

Now, at present, I am not a bull on the stock markets, but it is not because of any event risk, but rather high valuations. We aren’t at the same valuations that we experienced at the top of the dot-com bubble, but we are in the range of valuations that only existed from 1998-2000. At present the S&P 500 is expecting gains of just 2.24%/year over the next ten years.

Even this is not the long term. Okay, bad returns for ten years, and after that, back to historic norms. Fine, that’s right. But how many will panic in the process of a crash, and not hang on for the long-term?

I think it is worth edging asset allocations toward caution as valuations are so high. We can’t predict when the disaster will happen, but when it does, there will be better opportunities to deploy free cash.

As such, lighten up on risk assets, and prepare for the next drop in the stock market.

I wouldn?t say that property rights are a human right. Private property is not a feature in many indigenous societies – eg, Australian aborigines. In fact, the illegitimate assertion of property rights by European settlers have harmed the human rights of indigenous peoples in the New World and Antipodes. And Anglo-American attempts to enforce property rights in Iran and Central America led to many abuses of human rights.

I am not against property rights (after all, I am an investor). I would simply say that property rights is an instrument that can be used to foster human freedoms, but also restrict human freedoms.

We might agree more than you think. Note that I did not say, “Individual property rights.” Some societies have group property rights that are relatively equitable — kind of a benign socialism most of the time, though tough on those that are out of favor.

Many groups were expropriated by the Western powers which invaded and took control, and afterwards asserted their rights to control their new territory. They took away what was the property of those who were native. Now, it is one thing to do it by trading fairly. It’s another to do it via coercion or trickery. Oddly, the church I belong to was one of the few that opposed what was being done to the American Indians at the time they were being deprived of their lands without just compensation.

But the problem today is not that. The problem today is governments that make it impossible for average people to start businesses or own real estate. It holds back the poor, and discourages those in the middle class who have a hard time improving their lot in life. Thus I would continue to say property rights are a human right.

All rights can be used to bad ends, if misapplied. There is a good book called “THe Mystery of Capital” by Hernando de Soto. It goes into a lot of these issues. I mention it briefly in this article: One Dozen or so Books on Economics.

Thanks for your comment.