Photo Credit: Valerie || Photo taken from the coast of Key West at sunset. Relaxing and peaceful, so they say…

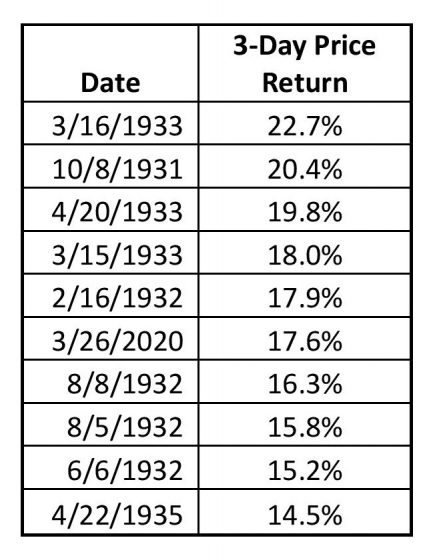

What an amazing three days. I’ve said to some of my clients that moves of this magnitude are highly unusual. How unusual?

The returns of the last three days would rank sixth in the top ten three-day moves upward for the S&P 500 since 1928. When did the rest of the top ten take place? During the Great Depression — four in 1932, three in 1933, and one each in 1931 and 1935.

Given the overall difficulties of the stock market in the Great Depression, one could say that the 2020 stock market should find being peers with which to keep company.

One more note about March 26th, 2020, that sets it apart: It’s the only one of the dates that may be a bounce up from a bear market low. The fastest bear market may become the fastest bull market if the S&P 500 closes above 2685 soon.

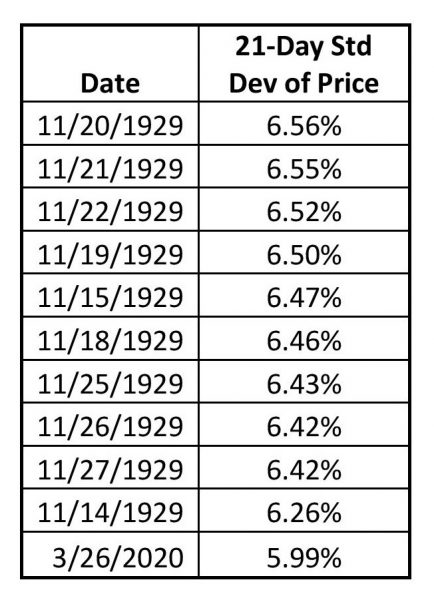

It Doesn’t Get Much Worse Than This?

Consider monthly price volatility. Using 21 days to represent a month, the standard deviations of price movements for March 26th would be the eleventh highest. When did the other ten take place. One day after another for ten trading days starting on November 14th, and ending on the 27th of the same month.

Do you feel like the current market action has slugged you hard? I do. That would be a normal feeling, as we haven’t been through anything quite like this in our lifetimes.

Even if you look at implied volatility, for which we only have data since 1986 (if you are looking at the old VIX, 21-day average volatility would have ranked 54th. 39 trading days starting on October 27th, 2008, and 14 trading days starting on November 3rd, 1987 ranked higher. Still it been fascinating to not see the VIX move down much over the last three days. Perhaps there are a lot of investors still aggressively buying puts and calls.

Four Interesting Periods in the Stock Market

So think about:

- The Great Depression

- Black Monday and related problems in 1987

- The Great Financial Crisis in 2008, and

- Now

The two “Greats” had collapses in asset prices and corresponding impairments of banks, and some other financial institutions. They were for practical purposes universal panics.

1987 was shocking, but it came back fast, and it didn’t have much collateral damage. The current time period? Well, banks are lending to creditworthy borrowers, and March is a record for US dollar denominated investment grade corporate bonds, Jon Lonski reported at Moody’s in his report released tonight. There’s no lack of liquidity to the big guys with normal balance sheets.

For CLOs, MLPs, repos and Mortgage REITs, that’s different. They are highly dependent on capital market conditions to do well. They are “fair weather” vehicles. In this situation, the Fed is extending itself in ways that it doesn’t need to, and for areas that should be left alone. Nonbanks should not be an interest of the Fed. If you’re going to take all systematic risk away from business, they’re going to behave in even more aggressive ways, and create an even bigger crisis. This one would have been small enough for the private sector to handle, once the initial wave furor over COVID-19 dies away in a couple of weeks.

Same for the Treasury. We don’t need the stimulus, and recessions help to clear out bad allocations of capital. This is a waste of the declining creditworthiness of the US Treasury, which will find itself challenged by a bigger crisis in 10-15 years, with no flexibility to deal with it.

Two Final Notes

I have a series of four articles called, “Goes down double-speed.” The market going down rapidly is less unusual than it going up rapidly. Typically the speed of down moves is twice as fast as up moves. For the current up moves to be so fast is astounding. I would say that it shouldn’t persist, but I think the market will be higher because the first wave of COVID-19 will fade.

And so I go back to one of my sayings: “Weird begets weird.” Weird things happen in clumps, in bunches. Much of it is driven by bad monetary and fiscal policies, including policies the encourage people and institutions to take on too much debt. Unusual factors include COVID-19 and the policy response to it. Part of it is cultural — we take too much risk as a culture, which works fabulously in the bull phase of the cycle, and horribly in the bear phase.

And thus I would say… prepare for more weird. Like COVID-19, it’s contagious.

As numerous market pundits have said for centuries, price does not always equal value. Prices went berserk because a number of very over-levered portfolios were forced to meet margin calls. When faced with a margin call, you must sell at whatever price you can get, not what the asset is worth.

Prices moved all over the place, the underlying value changed a lot less. It may take a few months, but once the over-levered are carried off the trading floors on stretchers, prices will start to move back toward value.

The big change turns out to be the strength – or rather continued weakening – of Uncle Sam’s balance sheet. I’ve heard all the academics with their pedantic arguments about the Treasury “printing” their way out of debt as though we lived in Zimbabwe or Argentina. Sorry to have to educate Bernanke and his followers, but he didn’t think of the printing press idea first. He is many centuries behind the curve. All the other currency printers who preceded him thought they were a special case too. “This time will be different” they all claimed. They all had the same outcome, and Uncle Sam won’t be different either.

With diminishing power of the purse, Uncle Sam won’t be able to prop up zombie corporations like Government Motors (many others). The healthcare and education complexes, dependent on tax exemptions and debt subsidies for their existence, will collapse too. Its not clear Uncle Sam will be able to continue transfer payments to the elderly (social security and medicare).

I am certain most of the elderly will receive checks. Its just that those checks will buy less and less. Means testing, by whatever name, will cut benefits to “the wealthy” and just like income taxes, the definition of “the wealthy” will expand over time. Eventually, the poor elderly will get “guaranteed” monthly SS checks that won’t cover even a week’s groceries. This isn’t really much of a prediction, since means testing of social security already started, and SS checks don’t cover much as it is. Necessity being the mother of invention, the US private sector was already re-emerging — long before Trump had his maga hats printed.

The welfare state of Europe is in far worse condition, and if history is any guide they will go back to war as their economies implode. Maybe their next war will be fought with Euros and natural gas cut-offs, instead of with bullets, but desperate people do desperate things.

I don’t understand how the USA has a shortage of test kits, and yet we have a “perfect” (down to single digit) count of CV-19 deaths. Are hospitals using test kits that are in shortage to test the dead? How come we have infinite kits to test the dead, but not the living? Something smells very fishy about the whole count.

If the death counts are correct, this pandemic is a non-event. More Americans were killed on federal highways since January than the reported CV19 death count.

If one subscribes to the doom porn on TV, and the “true” death count is double what is reported — this pandemic still wouldn’t rank in the top 3 causes of death in the USA in a typical year.

I understand the media’s desperate need for ratings / listeners / readers… but this hysteria is way out of touch with reality, even if we stipulate the death rate is much higher than reported.

I don’t know how COVID-19 will play out any more than anyone else. I will say that POTUS having gone from a hypothetically more relaxed position come Easter to potentially closing down travel over large areas (as some other countries have done) is enough for me to assume that the first wave will not fade as quickly as an optimistic assessment would posit. Hope you are right but expect differently. How much worse (a little, a lot, who knows) remains to be seen. The market will try to look through the problem, and may not get it right the first time.

Thanks for dozens of useful and informative posts over the years.

I’ll have another post on Monday, Lloyd. It looks like we’re around the halfway point now in the US. The US is not doing the worst of all the developed nations, and we can’t be as draconian as the Chinese, even if their statistics might be accurate.

The growth rate of new cases keeps declining in the US, with nary a hiccup. It takes 20-50 days after 10% of the ultimate cases are discovered for 99% of the ultimate cases to be discovered in the first wave. Basically it’s a month to discover the problem, and then a month or two of new cases accelerating, decelerating and declining.

It will happen. Then we will have to mop up local mini-epidemics.

People will remember that the same people who swore “Boris and Natasha” used their mind control device to put Trump in the White House, are the the same people screeching this panic. Trump Derangement Syndrome, take 3

Necessity will force a lot of people to stop going along with what they have suspected from the start is nothing more than a mass panic.

The infection numbers reflect “assumed” cases, because there are not enough test kits to have a true number. Even if the death count more than doubles from here, CV-19 won’t be in the top 5 causes of death in the USA. There is also reason to believe CV-19 deaths will match very closely a perceived reduction in “common” flu deaths — people with weakened immune systems who would have succumbed to common flu (without the media hysteria) instead died of coronavirus.