Goes Down Double-Speed (Update 4)

Markets always find a new way to make a fool out of you. ?Sometimes that is when the market has done exceptionally well, and you have been too cautious. ? That tends to be my error as well. ?I’m too cautious in bull markets, but on the good side, I don’t panic in bear markets, even the most severe of them.

The bull market keeps hitting new highs. ?It’s the second longest bull market in the last eighty years, and the third largest in terms of cumulative price gain. ?Let me?show you a graph that simultaneously shows how amazing it is, and how boring it is as well.

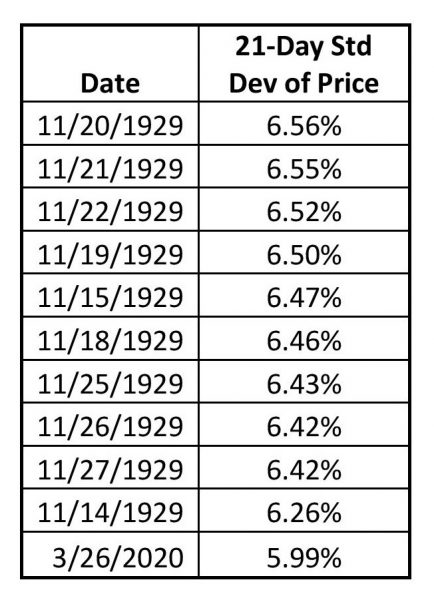

The amazing thing is how long the rally has been. ?We are now past 3000 days. ?What is kind of boring is this — once a rally gets past two years time, price return results fall into a range of around 1.1-2.0%/month for the rally as a whole, averaging around 1.4%/month, or 18.5% annualized. ?(The figure for market falling more than 200 days is -3.3%/month, which is slightly more than double the rate at which it rises. ?Once you throw in the shorter time frames, the ratio gets closer to double — presently around 2.18x. ?Note that the market rises are 3.2x as long as the falls. ?This is roughly similar to the time spans on the credit cycle.)

That price return rate of 1.4%/month isn’t boring, of course, and is?close to?where the stock market prediction model would have predicted back in March 2009, where it forecast total returns of around 16%/year for 10 years. ?That would have implied a level a little north of 2500, which is only 3% away, with 21 months to go.

Have you missed the boat?

If you haven’t been invested during this rally, you’ve most like missed more than 80% of the?gains of this rally. ?So yes, you have missed it.

?The Moving Finger writes; and, having writ,

Moves on: nor all thy Piety nor Wit

Shall lure it back to cancel half a Line,

Nor all thy Tears wash out a Word of it.?? Omar Khayy?m?from The Rubaiyat

In other words, “If ya missed the last bus, ya missed the last bus. ?Yer stuck.”

We can only manage assets for the future, and only our decrepit view of the future is of any use. ?We might say, “I have no idea.” and maintain a relatively constant asset allocation policy. ?That’s mostly what I do. ?I limit my asset allocation changes because it is genuinely difficult to time the market.

If you are tempted to add more money now, I would tell you to wait for better levels. ?If you can’t wait, then do half of what you want to do.

A wise person knows that the past is gone, and can’t be changed. ?So aim for the best in the future, which at present means having at least your normal percentage of safe assets in your asset allocation.

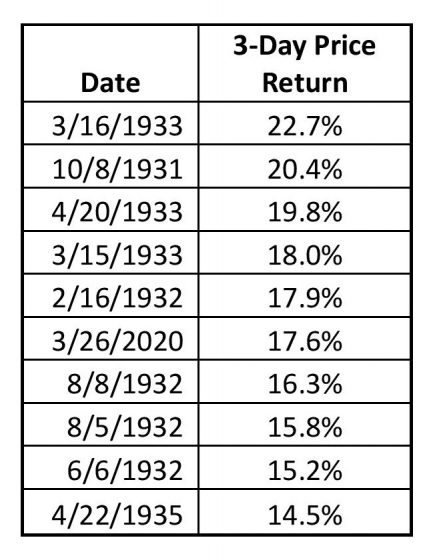

(the closing graph shows the frequency and size of market gains since 1928)