I want to start this evening with Twitter.? In the past, I used to do a decent degree of posts that summarized the news in a given area.? I don’t do those anymore.? Instead, I tweet significant articles 1-3 times a day. In general, I post the title of the article, a shortened link, and a quick comment on why it is right, wrong, important, etc.? If I want the StockTwits.com investment community to see it on their general ticker, I add a $$ somewhere in my post.? If there is a company I reference, I put a $ in front of its ticker, e.g., $AIG, and those following $AIG at StockTwits see the news.

Alternatively, if I want to have a potentially broader audience see it, I could put the hashtag #AIG in the post.? Anyone using Twitter and looking for #AIG will see it.

Beyond that, when I see articles that others have tweeted, and I agree, I retweet them, which republishes the tweet with attribution of the original tweeter to my followers.? Sometimes I get retweeted.? Retweeting can become a way of making something widely known. Sometimes I reply to tweets, or others reply to mine.? There can be some good conversations.

Twitter is not the same for everyone.? Some don’t tweet, but only use Twitter like a newswire.? Some don’t follow anyone, but use it as a means of updating their fans.? Some do both; you have to weigh off the time use.? Typically, I leave Twitter off most of the day, and then do my news updates in one set of tweets; it saves time.

Now, if you don’t do Twitter, and you don’t want to look at my Twitter page on the web, there are still two ways to get my economic commentary.? For those using RSS, you can click on the following link, and you will get my tweets: http://twitter.com/statuses/user_timeline/120209971.rss.? If you want to do this for another Twitter page, use this article.? For those with e-mail, you can use the following utility to either tweet or receive tweets by email.

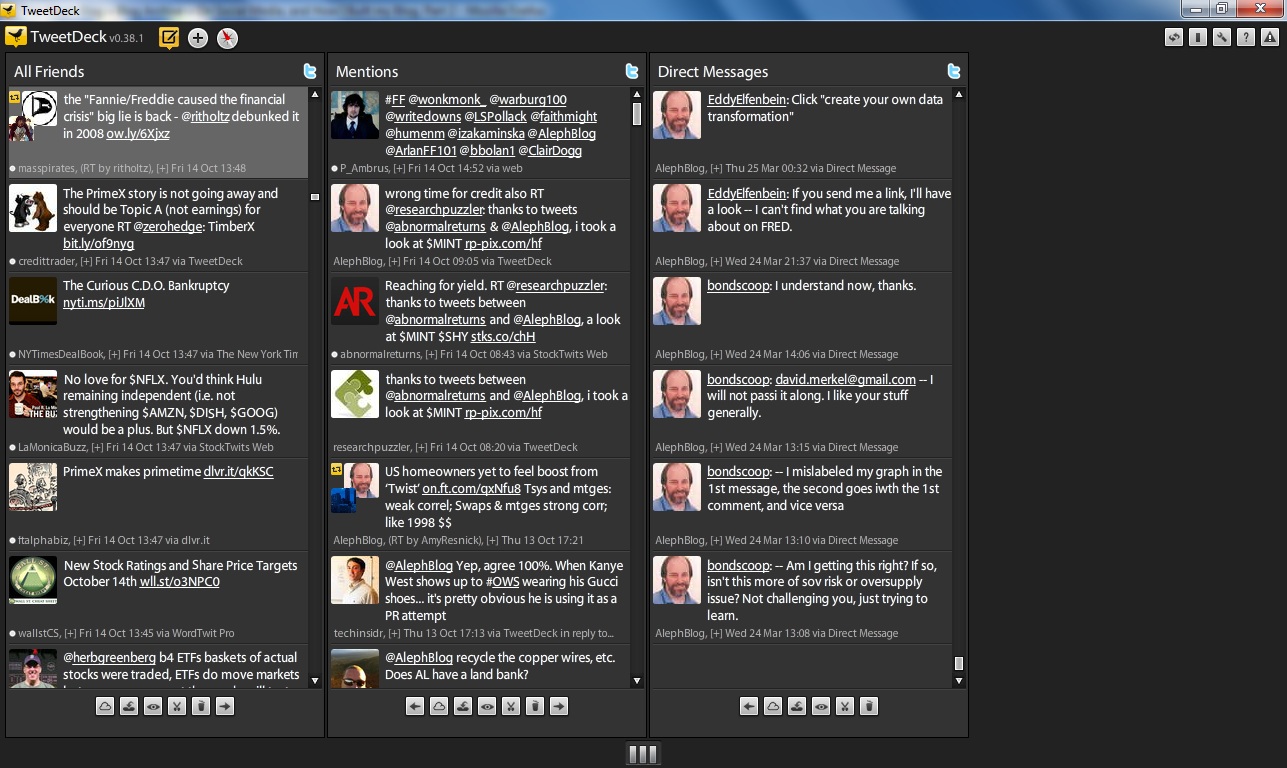

But if you are going to use Twitter a lot, I recommend that you use Tweetdeck for Twitter.

Tweetdeck allows you to organize the tweets you send, receive, get mentioned in, and private messages as well.? If you’re going to do a lot with Twitter, I recommend it.

Now I recently started using a service that links my blog, my Twitter account, and my LinkedIn account, such that when I write a new post, like this one, it posts at Twitter and LinkedIn.? Tweets go to LinkedIn as well.

Now Facebook, Twitter, Google, Yahoo, and to a lesser extent LinkedIn are becoming identity providers/gateways to using other sites, such that when you sign up for a new site, it can be simple as clicking on a Twitter link.? If you are logged into Twitter, Twitter asks you to confirm the link, and if you do, the signup is complete.

Back to the Blog

There are two aspects to choosing a theme/style for a blog.? First, you want it to look good, and fit the content that you are producing.? A minimalistic style works well for many blogs, particularly if content is simple as well.? But to the degree, that you want to come off polished, a more graphically sophisticated style can pay off.? Whatever you do, make sure you like it — that it fits the personality of what you are doing.

The second aspect of choosing a theme/style for utility.? How many columns do you want?? What do you want to put in them?? How many built in widgets/utilities do you want the theme to have?

This is what I did: I wanted three columns.? Center for main content, left for advertising, right for everything else.? Now, regarding advertising, all advertising at my blog is labeled as such.? That means most advertising deals proposed to me don’t go through when they hear my terms.

The same is true when I write any book reviews, and link to Amazon, or anytime where I have an economic interest in what I am writing about.? Full disclosure is given.? If I or my clients own a stock, and I write about it, I disclose the interest.

As for the right side of my blog, it starts with my disclaimer that tells people that I make mistakes, so do your own due diligence.? After that, my sites widgets divide up the content by time and categories.? After that comes my blogroll, links, and registration/login data, comments, trackbacks, ways to subscribe, awards, and then the odd stuff.

Just a moment on the Blogroll: I use it to identify who I read every day, without fail.? Usually that means they don’t do a lot of posts, or I would be spending too much time reading.? There are many good bloggers that I read irregularly, often because they are so prolific.? I read their best stuff when it gets featured at Abnormal Returns, which is the best linkfest for finance posts.

That brings up the more general topic of linkfests.? It is easier to start blogging by doing linkfests, pointing out what you agree and disagree with, and broadening out from there when you find your voice.

Tracking Popularity

If you want to track the popularity of your web presence, there are a lot of ways to do it, depending on what you are trying to analyze:

RSS — Feedburner

Blog — Quantcast, Google Analytics, Technorati, Alexa

Twitter — Tweet Grader

Total social media presence? — Peerindex, Klout

There’s no end to all the tracking you can do, and it is possible to waste a lot of time with it.

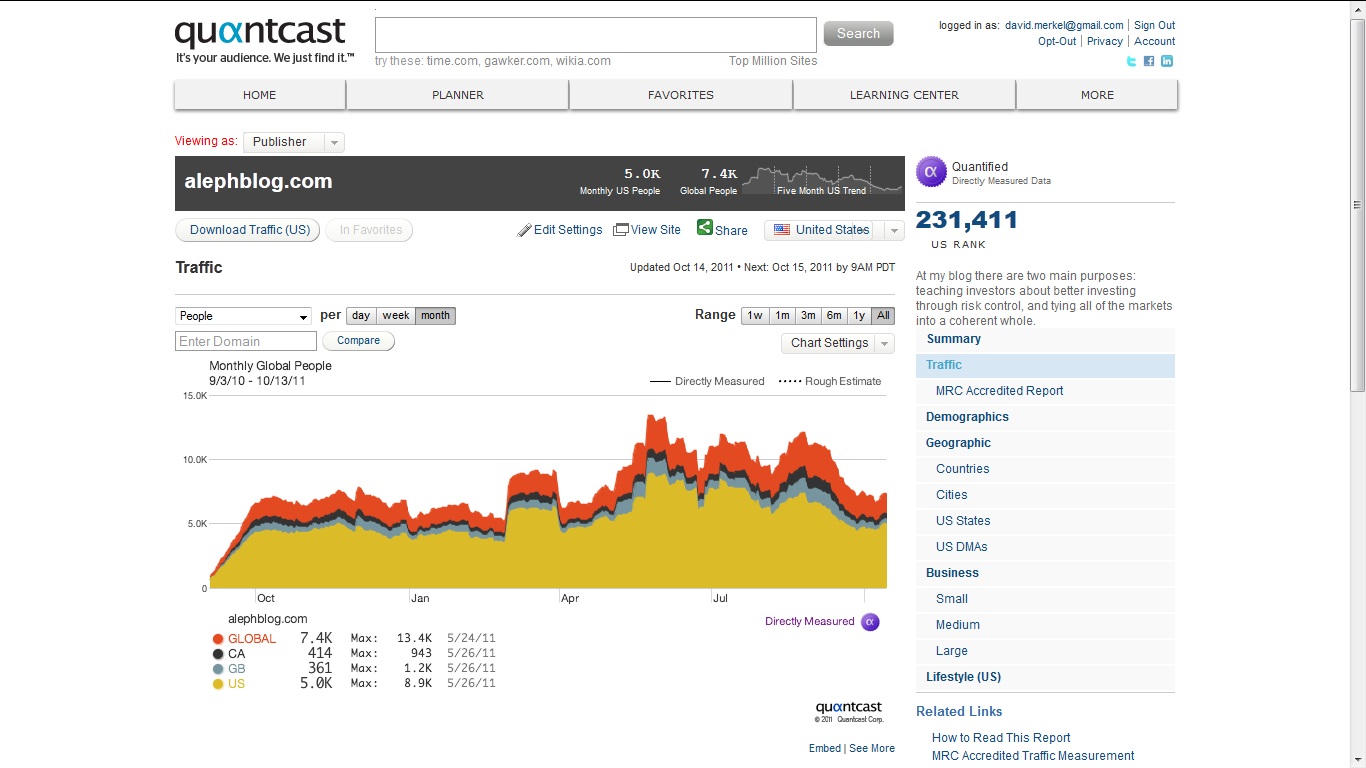

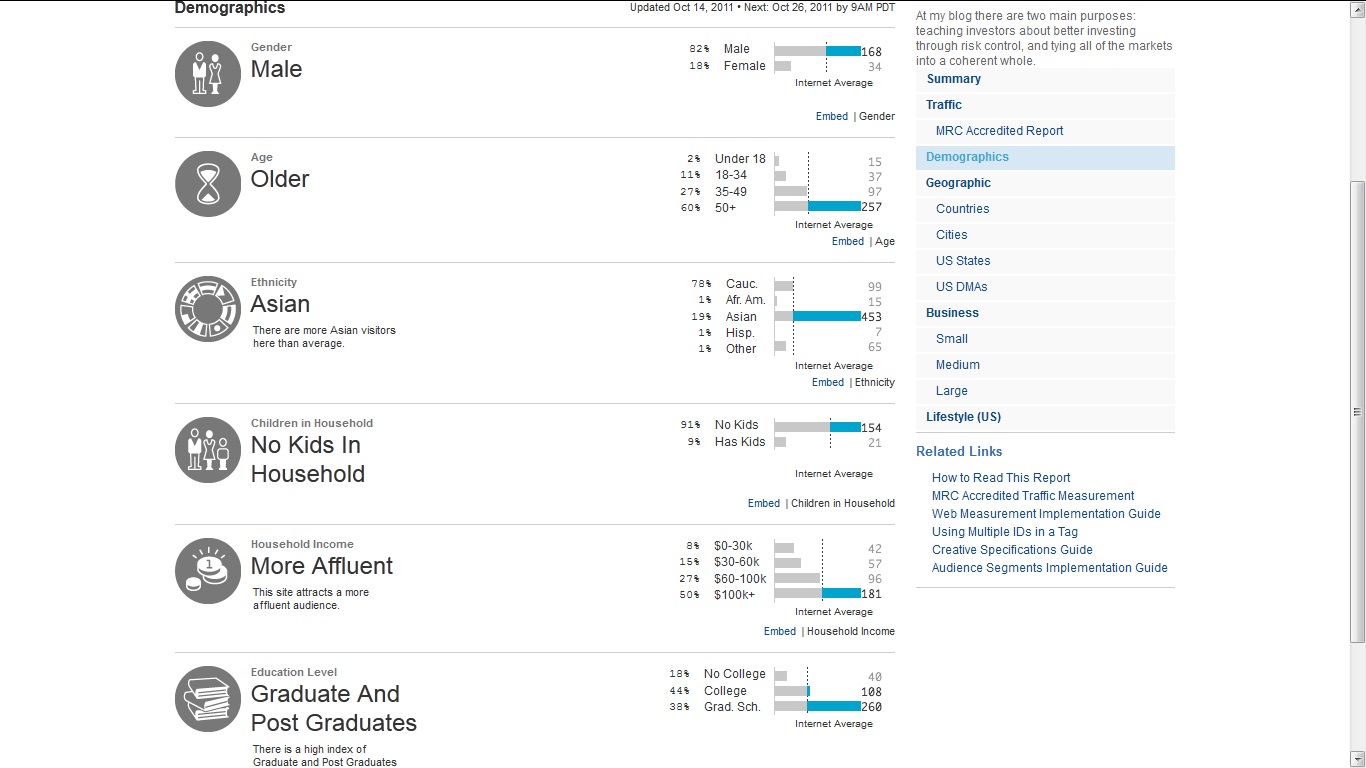

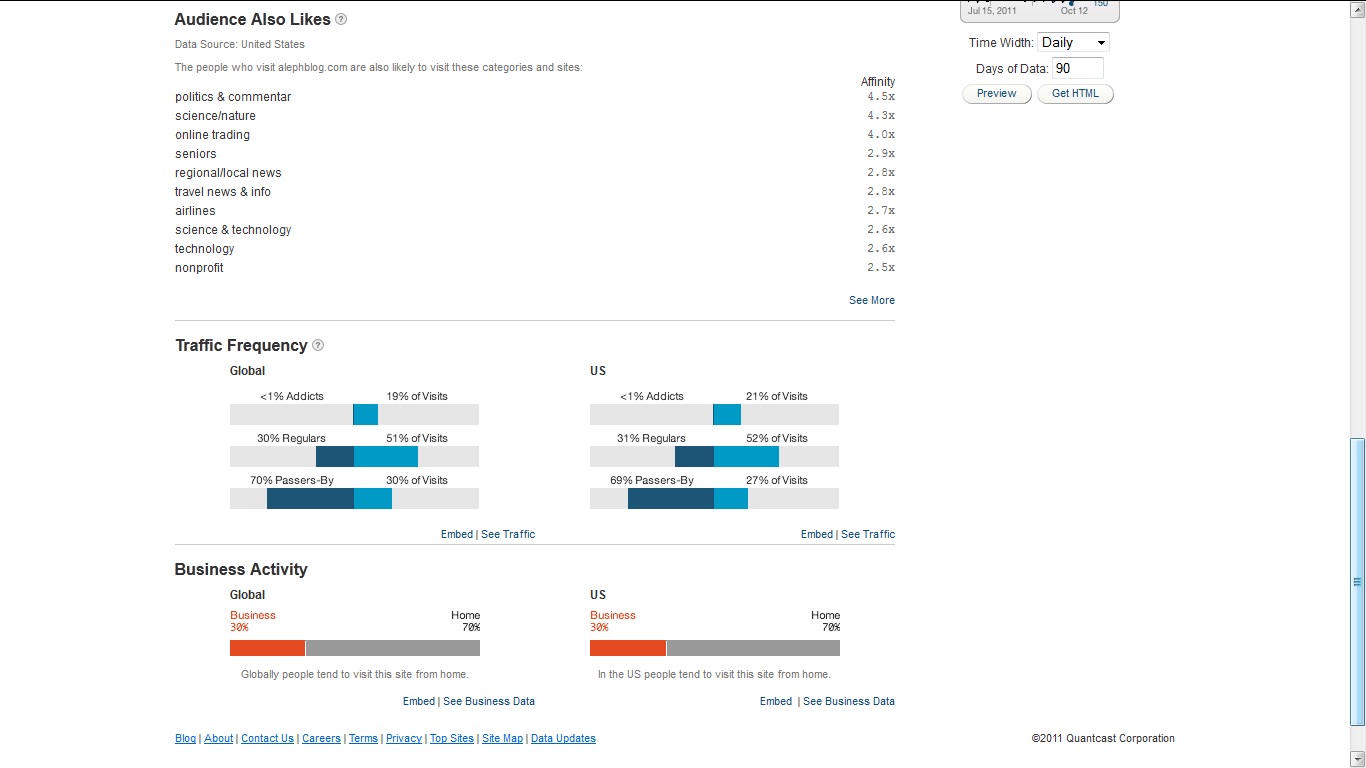

A little bit more about Quantcast, which is my main means of getting data on my readers.? The 3 follow screengrabs give you the summary data for my blog.? Quantcast puts a cookie on the computers that will allow it.? Without knowing exactly who the person is, it correlates other data that it knows about the person to tell me a decent amount of geographics and demographics about my audience, including who their internet service provider is.

LinkedIn

I’ve heard the following: Facebook is where younger people pretend they have friends.? Twitter is where older people make friends.? LinkedIn is where you go to make money.? Here’s my public profile.

Unlike at my blog, where I am relatively picky about who I place on my blogroll, I connect with most people who ask me on LinkedIn, if I can figure out any small aspect of advantage to either side.

My only tips for LinkedIn is to create as complete of a profile as you can, and don’t just take the lazy way in communicating with people by simply using default methods of contact.? Try to differentiate yourself, be respectful, and realize that many people won’t want to connect with you, and that’s fine.? Start small, and build.

Amazon

Though not thought of as social media, my book reviews from my blog that I cross-post at Amazon.com, generate approval from those seeking out good economics, business and finance books to read.? And sometimes people comment on my reviews, and vice-versa.? It could change, but at present, I’m in the Top 2000 reviewers using the New Reviewer Rank.

Wall Street All-Stars

Recently Cody Willard, a friend of mine, asked me contribute to a new site he was starting called Wall Street All-Stars, together with some writers that used to write for TheStreet.com.? What I am doing is taking old favorite posts from my blog, generally classics that are timeless, and writing 200-300 words after the end to explain how things are different now, where I was wrong or right, etc.? They are trying to make it a social site from the beginning.? If you get a chance, check out the site — it is about a month old and is a work in progress.

Summary

The internet is big, and I am not.? I don’t have a lot of resources.? But I lever what I can to make myself known, and it has made for me many friends, acquaintances and clients.? It can work for you as well; start small and add a little each month.? See what fits your personality, and where you have an edge versus other on the net, and give it your best shot.? You might end up surprised at the results you get.? Personally, it has been a surprise to me.