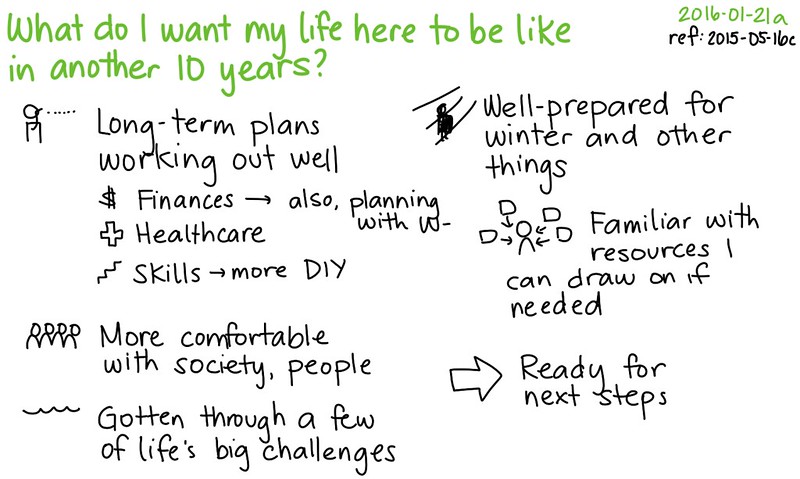

Photo Credit: Mike Licht || As a culture, we are very much “live for the moment.” But what happens when buyers of Treasuries decide that it’s not worth it anymore?

I am not a fan of the Democrats or of Big Government Republicans like Bush Jr. and Trump. In general, I think we need to shrink our government, decentralize, and de-lever our economy such that we make debt a smaller component of how we finance our lives. The Democrats talk about inequality, but they don’t really mean it. Increasing marginal tax rates is good show, but the real game is how income is calculated, and they won’t touch that, because their richest donors find ways to hide their income — the same as donors to the Republicans.

That’s why I call the governing elite in DC “The Purple Party.” A blend of red and blue, with just enough difference to get politically motivated donors to give, but practically doing the same thing, serving wealthy elites.

I’m going to make a post on COVID-19 next week, but my last post on the topic was too optimistic. That said, the politicians, particularly governors, are being scaremongers. They are vastly overestimating the size of the crisis.

What really bugs me are the foolish ideas being propounded by the Fed and politicians. Let me talk about a few of them.

1) Don’t close the stock or bond markets. Closing the markets does not eliminate volatility. It only hides it. Practically, it makes the price of securities to be zero for those who want to sell them. And, for those who left some cash on the side, it denies them the opportunity to profit from their wisdom.

2) The Fed should only hold short government debt. That is a neutral asset. Anything else makes the Fed play favorites in what they buy, whether it is mortgage-backed securities, municipal bonds, or corporates. Don’t let the Fed become a political institution, creating ad hoc policy by whose debt they do and don’t buy.

3) Don’t close businesses. Let all businesses set their own policies. They don’t want their workers to infect others. Let them operate.

The idea that there are “necessary businesses” is foolish. The “necessary businesses” rely on other businesses to be their suppliers.

What would be better would be to have extensive testing for COVID-19, and to quarantine those who are infected, and those who are not tested who had contact with those who are infected. Leave the rest of society free. Don’t close firms down, and then give some lame amount of government assistance to them. We do best when we are working. People staying at home lack the healthy stress that working provides.

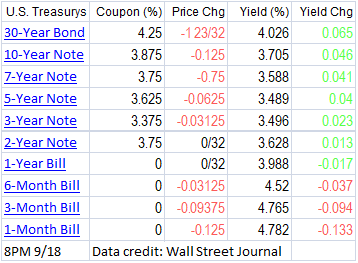

4) Now, if you have to give assistance, giving it to people directly is the best way. I advocated for that in the last financial crisis. But you should give it to all Americans equally, to avoid favoritism. Now, there is the issue of those who buy US Treasury debt objecting to the concept, and I can respect that. Why else do you think that the yield on 30-year Treasury Bonds has risen 0.8% over the last ten days?

There is no such thing as a free lunch, and with all those advocating excessive deficit spending, I would say “Yes, the past efforts have not disrupted the markets, but if you read economic history closely, no one can tell what will make the paradigm shift. Are you feeling lucky?”

Summary

From my reading of the data, I don’t see how this crisis lasts past the end of April. Yet there are governors of states foolishly shutting down businesses, and thinking that they are doing something good. “Shelter in place” is a recipe for turning all Americans into lawbreakers in the same manner as is with highway speed limits. Do you really want to ruin our culture via overly strict laws?

What of the poor people running out of money? What of the small businesses that go broke? Governments should focus on testing for the virus, and quarantining those who have it and those who have had contact and are untested.

In closing, I would encourage all readers to vote all incumbents out of office. They are not serving the interests of average Americans well. They are cowards who listen to scaremongers, and that includes Trump.

PS — some people might suggest that I am not kind to those that are hurting. It’s not true. I give over 10% of my income to charity each year. Beyond that, I would challenge people to consider Venezuela. Many small to medium-sized actions by Chavez and Maduro slowly robbed the country of economic vitality. The wealthiest nation in South America became the poorest.

The same could happen here. Economic disasters often spring from something small — remember Ben Bernanke saying that the risk from subprime mortgages was “well contained?” Yes, subprime mortgages were small, but they represented the marginal buyers of residential real estate, so when they failed, so did property prices. Like dominoes, they fell.

Thus I am saying to urge the government to not engage in policies that increase its deficits. You can’t tell when the last bit of debt will be the straw that breaks the back of the camel.