Bandaging Wounds from Another Promoted Stock Scam

Okay, time for the promoted stock scoreboard:

| Ticker | Date of Article | Price @ Article | Price @ 7/11/13 | Decline | Annualized | Splits |

| GTXO |

5/27/2008 |

2.45 |

0.012 |

-99.5% |

-64.6% |

|

| BONZ |

10/22/2009 |

0.35 |

0.003 |

-99.3% |

-73.2% |

|

| BONU |

10/22/2009 |

0.89 |

0.003 |

-99.7% |

-78.6% |

|

| UTOG |

3/30/2011 |

1.55 |

0.005 |

-99.7% |

-91.9% |

|

| OBJE |

4/29/2011 |

116.00 |

0.305 |

-99.7% |

-93.3% |

1:40 |

| LSTG |

10/5/2011 |

1.12 |

0.031 |

-97.2% |

-86.9% |

|

| AERN |

10/5/2011 |

0.0770 |

0.0003 |

-99.6% |

-95.7% |

|

| IRYS |

3/15/2012 |

0.261 |

0.003 |

-98.9% |

-96.7% |

|

| NVMN |

3/22/2012 |

1.47 |

0.300 |

-79.6% |

-70.5% |

|

| STVF |

3/28/2012 |

3.24 |

0.330 |

-89.8% |

-83.1% |

|

| CRCL |

5/1/2012 |

2.22 |

0.031 |

-98.6% |

-97.2% |

|

| ORYN |

5/30/2012 |

0.93 |

0.154 |

-83.4% |

-80.1% |

|

| BRFH |

5/30/2012 |

1.16 |

0.458 |

-60.5% |

-56.6% |

|

| LUXR |

6/12/2012 |

1.59 |

0.017 |

-98.9% |

-98.5% |

|

| IMSC |

7/9/2012 |

1.5 |

1.260 |

-16.0% |

-15.9% |

|

| DIDG |

7/18/2012 |

0.65 |

0.058 |

-91.1% |

-91.5% |

|

| GRPH |

11/30/2012 |

0.8715 |

0.141 |

-83.8% |

-94.9% |

|

| IMNG |

12/4/2012 |

0.76 |

0.150 |

-80.3% |

-93.3% |

|

| ECAU |

1/24/2013 |

1.42 |

0.360 |

-74.6% |

-94.9% |

|

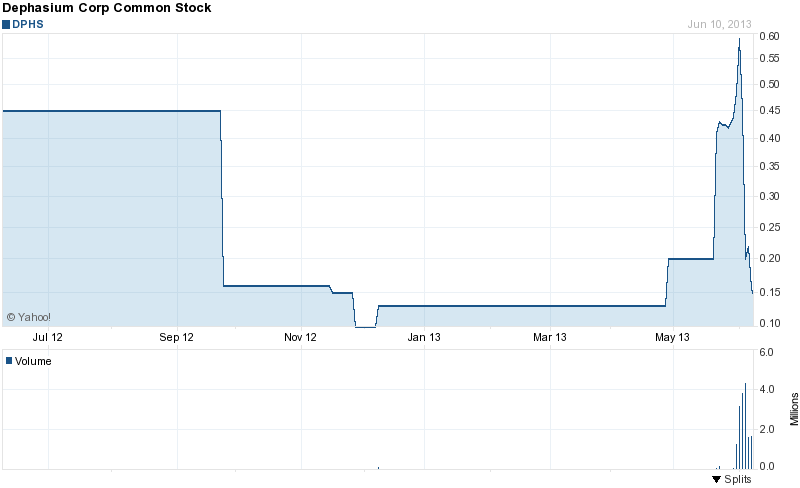

| DPHS |

6/3/2013 |

0.59 |

0.040 |

-93.2% |

-100.0% |

|

| POLR |

6/10/2013 |

5.75 |

0.600 |

-89.6% |

-100.0% |

|

| NORX |

6/11/2013 |

0.91 |

0.440 |

-51.6% |

-100.0% |

|

|

7/11/2013 |

Median |

-92.1% |

-92.6% |

They are predictably bad.? If anything, the last few promoted stocks have been exceptionally bad.? It makes me wonder whether players play the pump of the pump and dump are getting too numerous.? Maybe after a few more losses like POLR & NORX, there will be fewer players willing to speculate on companies with price momentum that are obviously bogus.

Tonight’s loss-to-be is Arch Therapeutics.? It was a distributor of auto parts that never made a dime of revenue called Almah, Inc., until four months ago.? It did the following:

On April 19, 2013, the Company entered into a Binding Letter of Intent (the ?LOI?) with Arch Therapeutics, Inc., a Massachusetts company (?Arch?), in connection with a proposed reverse acquisition transaction between the Company and Arch pursuant to which the Company would enter into a reverse triangular merger with Arch (the ?Merger?) and the Company would acquire all of the issued and outstanding capital stock and convertible notes and warrants of Arch in exchange for the issuance of 20,000,000 shares of the Company?s common stock to the shareholders of Arch. Arch operates as a life science company developing polymers containing peptides intended to form gel-like barriers over wounds to stop or control bleeding.

On April 19, 2013, subsequent to the Company?s fiscal quarter ended March 31, 2013, Mr. Powers resigned as the Company?s sole officer and director and Mr. Norchi was appointed as the Company?s director and sole officer, and Mr. Avtar Dhillon was appointed as a director.

On May 10, 2013, pursuant to the terms of the LOI, the Company entered into an Agreement and Plan of Merger (the ?Merger Agreement?) with Arch and Arch Acquisition Corporation, a Massachusetts corporation and the Company?s wholly-owned subsidiary (?Merger Sub?). In accordance with the Merger Agreement, Merger Sub will merge with and into Arch (the ?Merger?), with Arch surviving the Merger upon the terms and subject to the conditions set forth in the Merger Agreement.

As set forth in the Merger Agreement, the Company will acquire all of the issued and outstanding capital stock and convertible notes and warrants of Arch (through a reverse acquisition transaction) in exchange for the issuance to the holders thereof of 20,000,000 shares of the Company?s common stock. The stockholders of Arch will receive two and one-half shares of the Company?s common stock for each share of common stock of Arch held by them immediately prior to the effective time of the Merger.

Almah, no revenues, no earnings, negative net worth. Arch, a “promising” technology company that decides to buy a stock listing buying Almah in a reverse merger.? If the technology were so good, why not remain private and work with private equity, or enter into joint ventures with large medical technology companies that have incredible reach?

It beggars belief that one would merge with a virtually defunct company to build a strong medical technology company.? Leave aside all of the scam language in the promotion.? But here are some examples from the disclaimers:

- Facts stated in this article were supplied to endorser from third-party sources.

- XXX has been compensated $10,000 by YYY for endorsing this product, and ZZZ has been paid a $25,000 by YYY for sending out this advertisement.

- YYY, the third party advertiser, has paid $390,000 USD and is expected to pay an additional $400,000 to WWW as of June 20, 2013 for this advertising effort in an effort to build investor awareness.

- YYY. represents that it does not own any shares of Arch Therapeutics, Inc. (except for 2,500,000 shares of restricted stock) which YYY. will not sell, pledge or hypothecate or otherwise agree to dispose of for 90 days following the initial dissemination of this advertisement.

If I had a new way of treating wounds that was really effective, I would do it myself privately, or work with private equity.? As it is, this stock promotion is garbage, and not worthy of investment.

The only thing I can’t find is any connection between the promotion and the company.? The promotion doesn’t mention the past, and the company is seemingly not involved in the promotion.? Maybe an owner could be pushing it; they are the only ones that could profit from the promotion.