The Rules, Part LXIII

==========================

Onto the next rule:

“We pay disclosed compensation. ?We pay undisclosed compensation. ?We don’t pay both?disclosed compensation?and undisclosed compensation.”

I didn’t originate this rule, and I am not sure who did. ?I learned it at Provident Mutual from the Senior Executives of Pension Division when I worked there in the mid-’90s. ?There is a broader rule behind it that I will get to in a moment, but first I want to explain this.

There are many efforts in business, particularly in sales, where some?want to hide what they are truly making, so that they can make an above average income off of the unsuspecting. ?At the Pension Division of Provident Mutual, the sales chain worked like this: our representatives would try to sell our investment products to pension plans, both municipal and corporate. ?We preferred going direct if we could, but often there would be some fellow who had ingratiated himself with the plan sponsor, perhaps by providing other services to the pension plan, and he would become a gateway to the pension plan. ?His recommendation would play a large role in whether we made the sale or not.

Naturally, he wanted a commission. ?That’s where the rule came in, and from what I?remember at the time, many companies similar to us did not play by the rule. ?When the sale was made, the client would see a breakdown of what he was going to be charged. ?If we were paying disclosed compensation to the “gatekeeper,” we would point it out and mention that that was *all* the gatekeeper was making. ?If the compensation was not disclosed, the client would see the bottom line total charge, and he would have to evaluate if that was good or bad deal for plan participants.

Our logic was this: the plan sponsor would have to analyze the total cost anyway for a bundled service against other possible bundled and unbundled services. ?We would bundle or unbundle, depending on what the gatekeeper and client wanted. ?If either wanted everything spelled out we would do it. If neither wanted it spelled out, we would only provide the bottom line.

What we would never do is provide a breakdown that was incomplete, hiding the amount that the gatekeeper was truly earning, such that client would see the disclosed compensation, and think that it was the entire compensation of the gatekeeper.

We were the smallest player in the industry as far as life insurers went, but we were more profitable than our peers, and growing faster also. ?Our business retention was better because compensation surprises did not rise up to bite us, among other reasons.

Here’s the broader rule:

“Don’t be a Pig.”

Some of us?had a saying in the Pension Division, “We’re the good guys. ?We are trying to save the world for a gross margin of 0.25%/year on assets, plus postage and handling.” ?Given that what we did had almost no capital requirements, that was pretty good.

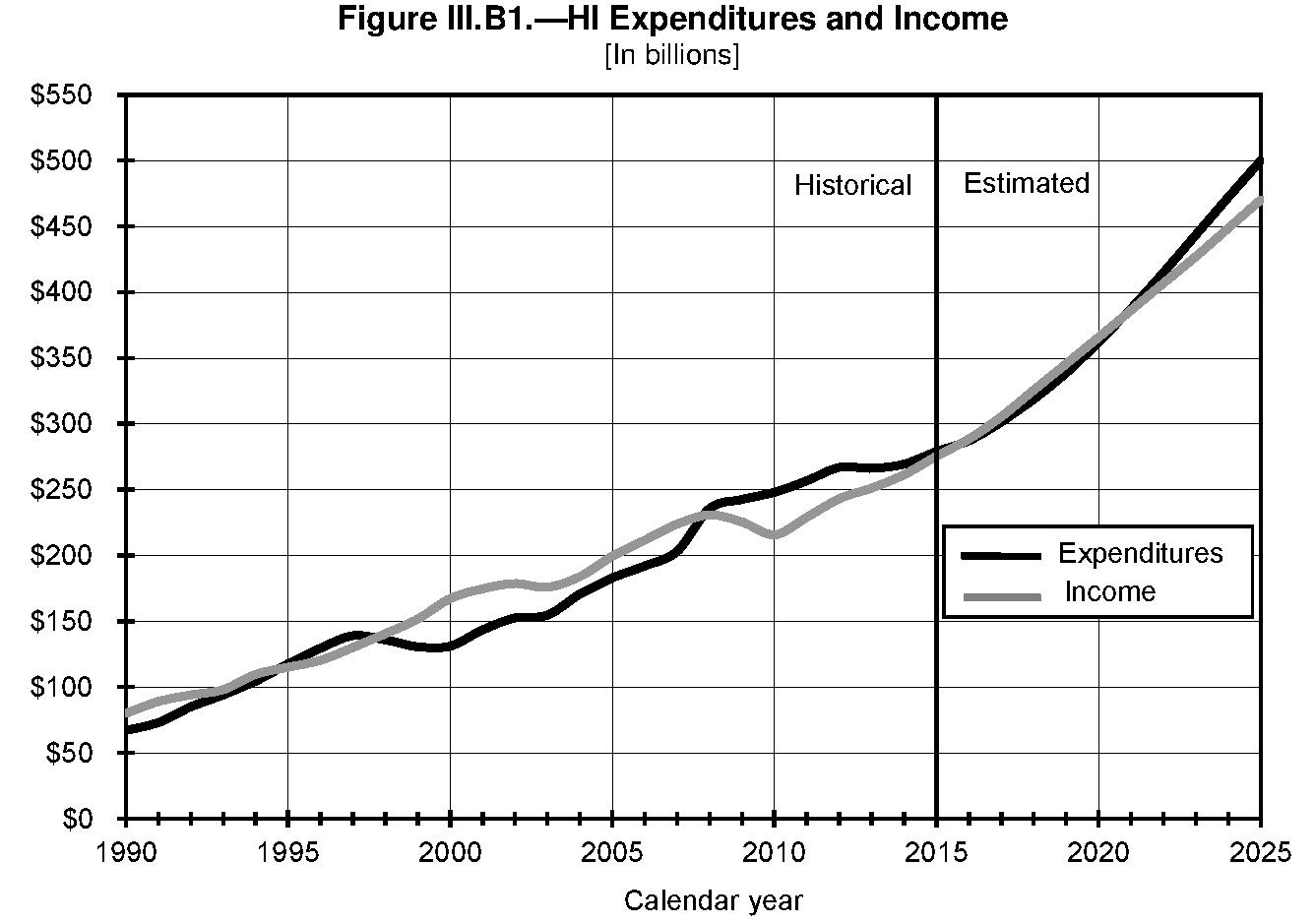

Most scandals over pricing involve some type of hiding. ?Consider the pricing of pharmaceuticals. ?Given the opaqueness is difficult to tell who is making what. ?Here is another?article on the same topic?from the past week.

In situations like this, it is better to take the high road, and make make your pricing more transparent than your competitors, if not totally transparent. ?In this world where so much data is shared, it is only a matter of time before someone connects the dots on what is hidden. ?Or, one farsighted competitor (usually the low cost provider) decides to lay it bare, and begins winning business, cutting into your margins.

I’ll give you an example from my own industry. ?My fees may not be the lowest, but they are totally transparent. ?The only money I make comes from a simple assets under management fee. ?I don’t take soft dollars. ?I make money off of asset management that is?aligned with what I myself own. ?(50%+ of my total assets and 80%+ of my liquid assets are invested exactly the same as my clients.)

Why should I muck that up to make a pittance more? ?It’s a nice model; one that is easy to defend to the regulators, and explain to clients.

We probably would not have the fuss over the fiduciary rule if total and prominent disclosure of fees were done. ?That said, how would the brokers have lived under total transparency? ?How would life insurance salesmen live? ?They would still live, but there would be fewer of them, and they would probably provide more services to justify their compensation.

Even as a bond trader, I learned not to overpress my edge. ?I did not want to do “one amazing trade,” leaving the other side wounded. ?I wanted a stream of “pretty good” trades. ?An occasional tip to a broker that did not know what he was doing would make a “friend for life,” which on Wall Street could last at least a month!

You only get one reputation. ?As Buffett said to the Subcommittee on Telecommunications and Finance of the Energy and Commerce Committee of the U.S. House of Representatives back in 1991 regarding Salomon Brothers:

I want the right words and I want the full range of internal controls. But I also have asked every Salomon employee to be his or her own compliance officer. After they first obey all rules, I then want employees to ask themselves whether they are willing to have any contemplated act appear the next day on the front page of their local paper, to be read by their spouses, children, and friends, with the reporting done by an informed and critical reporter. If they follow this test, they need not fear my other message to them: Lose money for the firm, and I will be understanding; lose a shred of reputation for the firm, and I will be ruthless.

This is a smell test much like the Golden Rule. ?As Jesus said, “Therefore, whatever you want men to do to you, do also to them, for this is the Law and the Prophets.” (Matthew 7:12)

That said, Buffett’s rule has more immediate teeth (if the CEO means it, and Buffett did), and will probably get more people to comply than God who only threatens the Last Judgment, which seems so far away. ?But I digress.

Many industries today are having their pricing increasingly disclosed by everything that is revealed on the Internet. ?In many cases, clients are asking for a greater justification of what is charged, or, are looking to do price and quality comparison where they could not do so previously, because they did not have the data.

Whether in financial product prices, healthcare prices, or other places where pricing has been bundled and secretive, the ability to hide is diminishing. ?For those who do hide their pricing, I will offer you one final selfish argument as to why you should change: given present trends, in the long-run, you are fighting a losing battle. ?Better to earn less per sale with happier clients, than to rip off clients now, and lose then forever, together with your reputation.