Like a Cardinal, The Price Action Will Be Red

Okay, let’s roll the promoted stocks scoreboard:

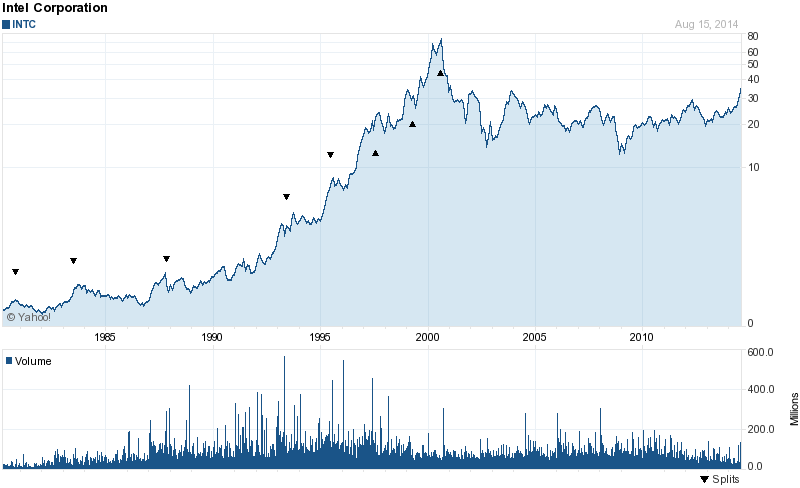

| Ticker | Date of Article | Price @ Article | Price @ 1/20/15 | Decline | Annualized | Dead? |

| GTXO | 5/27/2008 | 2.45 | 0.011 | -99.6% | -55.6% | |

| BONZ | 10/22/2009 | 0.35 | 0.000 | -99.9% | -72.5% | |

| BONU | 10/22/2009 | 0.89 | 0.000 | -100.0% | -82.3% | |

| UTOG | 3/30/2011 | 1.55 | 0.000 | -100.0% | -92.0% | Dead |

| OBJE | 4/29/2011 | 116.00 | 0.069 | -99.9% | -86.3% | Dead |

| LSTG | 10/5/2011 | 1.12 | 0.004 | -99.7% | -82.5% | |

| AERN | 10/5/2011 | 0.0770 | 0.0000 | -100.0% | -93.4% | Dead |

| IRYS | 3/15/2012 | 0.261 | 0.000 | -100.0% | -100.0% | Dead |

| RCGP | 3/22/2012 | 1.47 | 0.003 | -99.8% | -89.5% | |

| STVF | 3/28/2012 | 3.24 | 0.360 | -88.9% | -54.2% | |

| CRCL | 5/1/2012 | 2.22 | 0.004 | -99.8% | -90.2% | |

| ORYN | 5/30/2012 | 0.93 | 0.013 | -98.6% | -80.1% | |

| BRFH | 5/30/2012 | 1.16 | 0.466 | -59.8% | -29.2% | |

| LUXR | 6/12/2012 | 1.59 | 0.002 | -99.9% | -92.3% | |

| IMSC | 7/9/2012 | 1.5 | 0.910 | -39.3% | -17.9% | |

| DIDG | 7/18/2012 | 0.65 | 0.003 | -99.6% | -89.1% | |

| GRPH | 11/30/2012 | 0.8715 | 0.021 | -97.6% | -82.5% | |

| IMNG | 12/4/2012 | 0.76 | 0.010 | -98.7% | -86.9% | |

| ECAU | 1/24/2013 | 1.42 | 0.000 | -100.0% | -98.4% | |

| DPHS | 6/3/2013 | 0.59 | 0.003 | -99.5% | -96.0% | |

| POLR | 6/10/2013 | 5.75 | 0.001 | -100.0% | -99.5% | |

| NORX | 6/11/2013 | 0.91 | 0.008 | -99.1% | -94.7% | |

| ARTH | 7/11/2013 | 1.24 | 0.200 | -83.9% | -69.7% | |

| NAMG | 7/25/2013 | 0.85 | 0.013 | -98.5% | -94.1% | |

| MDDD | 12/9/2013 | 0.79 | 0.022 | -97.2% | -95.9% | |

| TGRO | 12/30/2013 | 1.2 | 0.056 | -95.3% | -94.5% | |

| VEND | 2/4/2014 | 4.34 | 0.655 | -84.9% | -86.1% | |

| HTPG | 3/18/2014 | 0.72 | 0.008 | -98.9% | -99.5% | |

| WSTI | 6/27/2014 | 1.35 | 0.150 | -88.9% | -97.9% | |

| APPG | 8/1/2014 | 1.52 | 0.035 | -97.7% | -100.0% | |

| 1/20/2015 | Median | -99.3% | -89.8% |

It is truly amazing how predictable the losses are from promoted stocks, and that is why you should never buy them. Today’s loser-in-waiting is Cardinal Resources [CDNL]. ?The promoters purport that this company will provide cheap clean fresh water to the world, and will make a fortune off of that. ?Now let’s look at some facts:

What commends this stock to you? ?Is it:

- That it has never earned any money?

- That the firm has had a negative net worth for the last four years?

- That their auditors doubted on the last 10-K that this company would be a “going concern?”

- That the company 12 months ago was known as JH Designs, which was in?the “home staging and interior design services business?”

- That the writers of the promotion got paid $30,000 to write the speculative fiction of the promotion?

- That affiliated shareholders of CDNL paid another $670,000 to publish speculative fiction about the company to unwitting people in an effort to raise the stock price, so that they can sell their shares?

Here, have a look at part of the disclaimer written in five-point type on the glossy ad they sent me in the mail:

Resources Kingdom Limited was paid by non-affiliate shareholders who fully intend to sell their shares without notice into this Advertisement/market awareness campaign, including selling into increased volume and share price that may result from this Advertisement/market awareness campaign. The non-affiliate shareholders may also purchase shares without notice at any time before, during or after this Advertisement/market awareness campaign. Non-affiliate shareholders acted as advisors to Resources Kingdom Limited in this Advertisement and market awareness campaign, including providing outside research, materials, and information to outside writers to compile written materials as part of this market awareness campaign.

Thus, we know who is sponsoring and profiting from this scam. ?It is existing shareholders who want to sell. ?I can tell you with certainty that you should not buy this, and that if you own it, you should sell it. ?There is one significant party that implicitly agrees with that assessment — the company itself, which issued shares at a price of ten cents per share in 2014, according to the recent 10-Q, if you look at the balance sheet and cash flow statements.

Avoid this company, and avoid all situations where stocks are promoted. ?They are bad news for all investors. ?Good investments never need promotion.