The Butterfly Machine

There’s a phenomenon called the Butterfly Effect. ?One common quotation is “It has been said that something as small as the flutter of a butterfly’s wing can ultimately cause a typhoon halfway around the world.”

Today I am here to tell you that for that to be true, the entire world would have to be engineered to allow the butterfly to do that. ?The original insight regarding how small changes to complex systems occurred as a result of changing a parameter by a little less than one ten-thousandth. ?Well, the force of a butterfly and that of a large storm are different by a much larger margin, and the distances around the world contain many effects that dampen any action — even if the wind travels predominantly one direction for a time, there are often moments where it reverses. ?For the butterfly flapping its wings to accomplish so much, the system/machine would have to be perfectly designed to amplify the force and transmit it across very long distances without interruption.

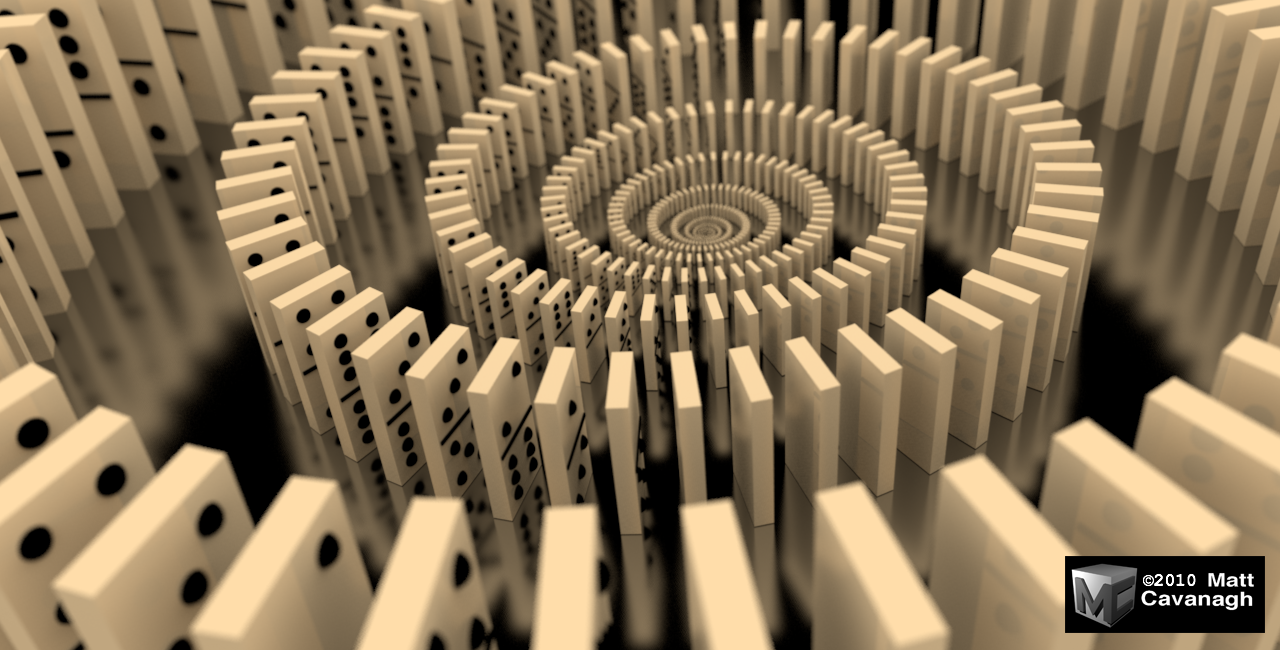

I have three analogies for this: the first one is arrays of dominoes. ?Many of us have seen large arrays of dominoes set up for a show, and it only takes a tiny effort of knocking down the first one to knock down the rest. ?There is a big effect from a small initial?action. ?The only way that can happen, though, is if people spend a lot of time setting up an unstable system to amplify the initial action. ?For anyone that has ever set up arrays of dominoes, you know that you have to leave out dominoes regularly while you are building, because accidents will happen, and you don’t want the whole system to fall as a result. ?At the end, you come back and fill in the missing pieces before showtime.

The second example is a forest fire. ?Dry conditions and the buildup of lower level brush allow for a large fire to take place after some small action like a badly tended campfire, a cigarette, or a lightning strike starts the blaze. ?In this case, it can be human inaction (not creating firebreaks), or action (fighting fires allows the dry brush to build up) that helps encourage the accidentally started fire to be a huge one, not merely a big one.

My last example is markets. ?We have infrequently?seen volatile markets where the destruction?is huge. ?A person?with a modest knowledge of statistics will say something like, “We have just witnessed a 15-standard deviation event!” ?Trouble is, the economic world is more volatile than a normal distribution because of one complicating factor: people. ?Every now and then, we engineer crises that are astounding, where the beginning of the?disaster seems disproportionate to the end.

There are many actors that take there places on stage for the biggest economic disasters. ?Here is a partial list:

- People need to pursue speculation-based and/or debt-based prosperity, and do it as a group. ?Collectively, they need to take action such that the prices of the assets that they pursue rise significantly above the equilibrium levels that ordinary cash flow could prudently finance.

- Lenders have to be willing to make loans on inflated values, and ignore older limits on borrowing versus likely income.

- Regulators have to turn a blind eye to the weakened lending processes, which isn’t hard to do, because who dares oppose a boom?? Politicians will?play a role, and label prudent regulations as “business killers.”

- Central bankers have to act like hyperactive forest rangers, providing liquidity for the most trivial of financial crises, thus allowing the dry tinder of bad debts to build up as bankers use cheap funding to make loans they never dreamed that they could.

- It helps if you have parties interested in perpetuating the situation, suggesting that the momentum is unstoppable, and that many people are fools to be passing up the “free money.” ?Don’t you know that “Everybody ought to be rich?” [DM: then who will deliver the pizza? ?Are you really rich if you can’t get a pizza delivered?] ?These parties can be salesmen, journalists, authors, etc. whipping up a frenzy of speculation. ?They also help marginalize as?”cranks” the wise critics who point out that the folly eventually will have to end.

Promises, promises. ?And all too good to be true, but it all looks reasonable in the short run, so the game continues. ?The speculation can take many forms: houses, speculative companies like dot-coms or railroads, even stocks themselves on sufficient margin debt. ?And, dare I say it, it can even apply to old age security schemes, but we haven’t seen the endgame for that one yet.

At the end, the disaster appears out of nowhere. ?The weak link in the chain breaks — vendor financing, repo financing, a run on bank deposits, margin loans, subprime loans — that which was relied on for financing becomes recognized as a short-term?obligation that must be met, and financing terms change dramatically, leading the entire system to recognize that many assets are overpriced, and many borrowers are inverted.

Congratulations, folks, we created a black swan. ?A very different event appears than what many were counting on, and a bad?self-reinforcing cycle ensues. ?And, the proximate cause is unclear, though the causes were many in society pursuing an asset boom, and borrowing and speculating as if there is no tomorrow. ?Every individual action might be justifiable, but the actions as a group lead to a crisis.

In closing, though I see some bad lending reappearing, and a variety of assets at modestly speculative prices, there is no obvious crisis facing us in the short-run, unless it stems from a foreign problem like Chinese banks. ?That said, the pension promises made to those older in most developed countries are not sustainable. ?That one will approach slowly, but it will eventually bite, and when it does, many will say, “No one could have predicted this disaster!”