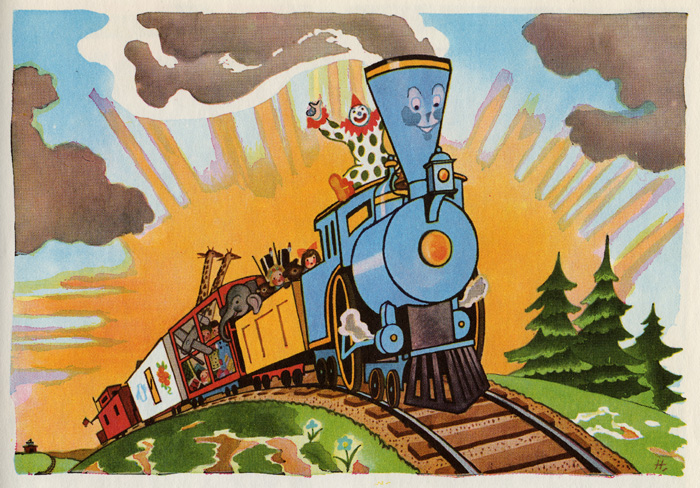

The Little Market that Could

======================================

So what do you think of the market?? Why are both actual and implied volatility so low?? Why are the moves so small, but predominantly up?? Is this the closest impression of the Chinese Water Torture that a stock market can pull off?

Why doesn’t the market care about external and internal risks?? Doesn’t it know that we have divisive, seemingly incompetent President who looks like he doesn’t know how to do much more than poke people in the eyes, figuratively?? Doesn’t it know that we have a divided, incompetent Congress that can’t get anything of significance done?

Leaving aside the possibility of a war that we blunder into (look at history), what if the inability of Washington DC to do anything is a plus?? Government on autopilot for four years, maybe eight if we decide we are better of without change — is that a plus or minus?? Just ignore the noise, Trump, other politicians, media… ahh, the quiet could be nice.

Then think about Baby Boomers showing up late for retirement, and wondering what they are going to do.? Then think about their surrogates, the few who still have defined benefit pension plans.? What are they going to do?? Say that the rate that they are targeting for investment earnings is 7%/year forever.? Even if my model for investment returns is wrong in a pessimistic way — i.e., my 4% nominal should be 6%/year nominal, you still can’t hit your funding target.? As for those with defined contribution plans, when you are way behind, even contributing more won’t do much unless investment earnings provide some oomph.

I am personally not a fan of TINA — “there is no alternative” to stocks in the market, but I recognize the power of the idea with some.? It is my opinion that more people and their agents will run above average risks in order to try to hit an unlikely target rather than lock in a loss versus what is planned.? Most will “muddle in the middle” taking some risk even with a high market, and realizing that they aren’t going to get there, but maybe a late retirement is better than none.

That’s the power of bonds returning 3% at best over the forecast horizon, unless interest rates jump, and then we have other problems, like risk assets repricing.? If you are older, almost no plan is achievable at reasonable cost if you are coming to the game now, rather than starting 15+ years ago.

And so I come to “the little market that could…” for now.? My view is that those with retirement obligations to fund are bidding up the market now.? That does two things.? Shares of risk assets (stocks) move from the hands of stronger investors to weaker investors, while cash flows the opposite direction.? In the process, prices for risk assets get bid up relative to their future free cash flows.

Unlike “the little engine that could,” the little market that could has climbed some small hills relative to the funding targets that investors need. Ready for the Himalayas?? The trouble with those targets is that regardless of what the trading price of the risk assets is, the cash flows that they produce will not support those targets.

Thought experiment: imagine that the stock market was gone and all the shares we held were of private companies that were difficult and expensive to trade.? ?Pension plans would estimate ability to meet targets by looking at forecasts of the underlying returns of their private investments, rather than a total return measure.

Well, guess what?? In the long run, the returns from public stock investments reflect just that — the distributable amount of earnings that they generate, regardless of what a marginal bidder is willing to pay for them at any point in time.? Stocks aren’t magic, any more than the firms that they represent ownership in.

So… we can puzzle over the current moment and wonder why the market is behaving in a placid, slow-climbing manner.? Or, we can look at the likely inadequacy of asset cash flows versus future demands for those cash flows for retirement, etc.? Personally, I think they are related as I have stated above, but the second view, that asset returns will not be able to fund all planned retirement needs is far more certain, and is one mountain that “the little market that could” cannot climb.

Thus, consider the security of your own plans, and adjust accordingly.? As I commented recently, for older folks with enough assets, maybe it is time to lock in gains.? For others, figure out what adjustments and compromises will need to be made if your assets can’t deliver enough.

Tough stuff, I know.? But better to be realistic about this than to be surprised when funding targets are not reached.